Книга: Английский язык. Практический курс для решения бизнес-задач

Назад: Aeroflot DCF Model (Base Case Scenario)

Дальше: Essential Vocabulary

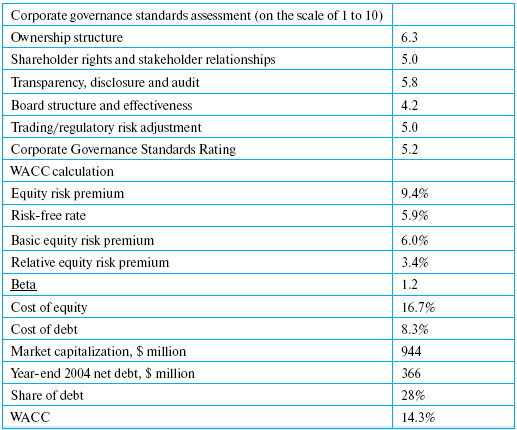

WACC Calculations

Another valuation method we used is an EV/EBITDA multiple-based calculation. As GEM peers have an average 2005E EBITDA multiple of 7.4, we use 7.0 for Aeroflot’s 2008E EBITDA multiple. The fair value derived from a 2008E EV/EBITDA multiple of 7.0 is $0.85.

We take $1.0 as our 12-month target price, which implies an 18% upside from the current price level.

Source: N. Zagvozdina, V. Tskhovrebov, Renaissance Capital, Aeroflot:

Taking off, Feb. 2004, (excerpt),

Назад: Aeroflot DCF Model (Base Case Scenario)

Дальше: Essential Vocabulary