Книга: Английский язык. Практический курс для решения бизнес-задач

Назад: Methods of Target Price Valuation

Дальше: WACC Calculations

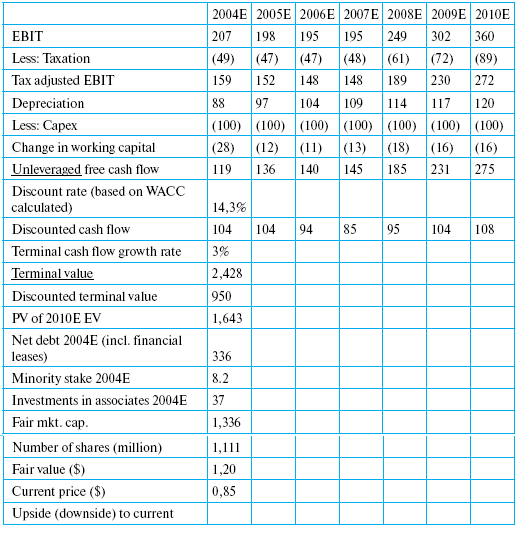

Aeroflot DCF Model (Base Case Scenario)

For the WACC calculation, we used methodology, which determines the stock specific equity risk premium based on corporate governance rating (CGR) (1 being the lowest, 10 the highest). Our CGR for Aeroflot is 5.2. This compares with a 6.2 CGR for Baltika, 8.2 for Wimm-Bill-Dann, and 6.5 for SeverstalAvto. For the risk-free rate, we used a 3-month moving average on the mid yield on Russia’s 10-year sovereign bonds.

Назад: Methods of Target Price Valuation

Дальше: WACC Calculations