The tax computation is quite complicated in some countries; tax percentages applied will be based on customer location. For example, when you sell a product to the customer within the state, the tax applicable is 15%. But for the same product when it sold to the customer outside the state the tax applicable is 5%.

It is difficult to check the customer location and change the tax on an invoice for every customer, as Odoo applies the default tax on the product. Odoo has a feature called fiscal position. By using this feature, we can change not only Tax but also Accounts, depending on the customer location.

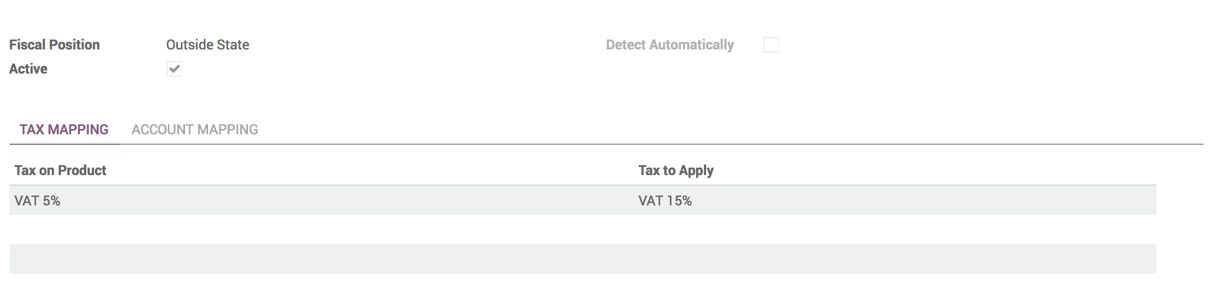

To set up Fiscal Position, go to Configuration | Fiscal Position under the Accounting application. Create a new position and set the name to Outside State, and then set TAX MAPPING. For example, replace 5% with the 15%. Check the following screenshot:

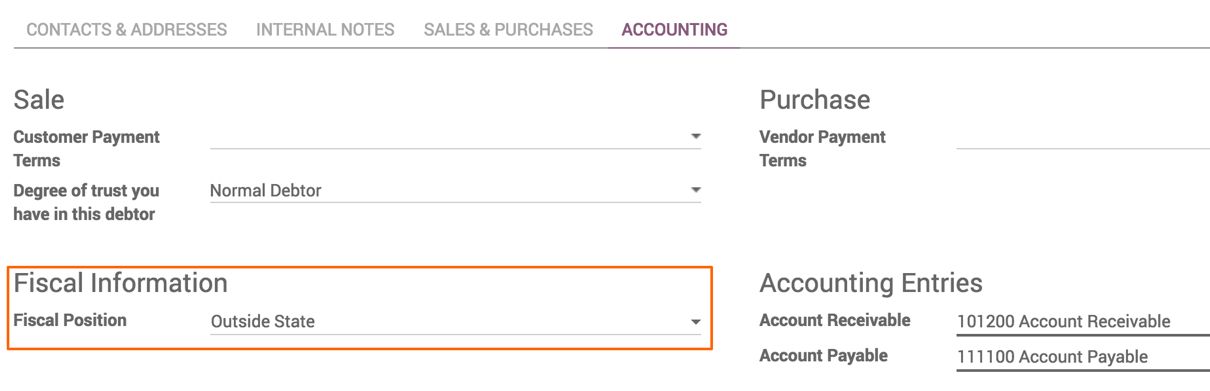

Apply Fiscal Position on the customers who are outside the state; you will find that field under the ACCOUNTING tab.

The right fiscal position will be applied automatically when you create a customer. The Detect Automatically option helps you to configure Country Group and Country with the Zip range. When creating a customer, the right fiscal position will be applied automatically:

Let's create an invoice for a customer who is outside the state, and check what tax Odoo will apply and compute on the sale of Material. The default tax is VAT 15%; this will be replaced with VAT 5% when you have a customer located outside the state.