Sometimes, a business needs to have the tax included in the product price, mostly for the retail business or it is also known as business to customer. Retail sales need the tax to be included in the product price. There are two ways to configure the product price included in tax as follows:

- Add the tax additionally on top of the product

- Compute the product price including tax in it

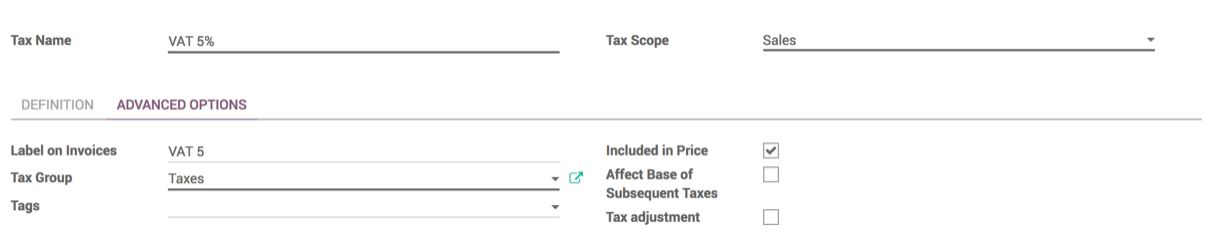

To enable the tax to be included in the price, the tax has to be configured. Open the tax configuration you would like to include in the product price, and select the Included in Price checkbox available under the ADVANCE OPTIONS tax:

The tax amount will be detected from the product price as we have configured the tax included in the product price.

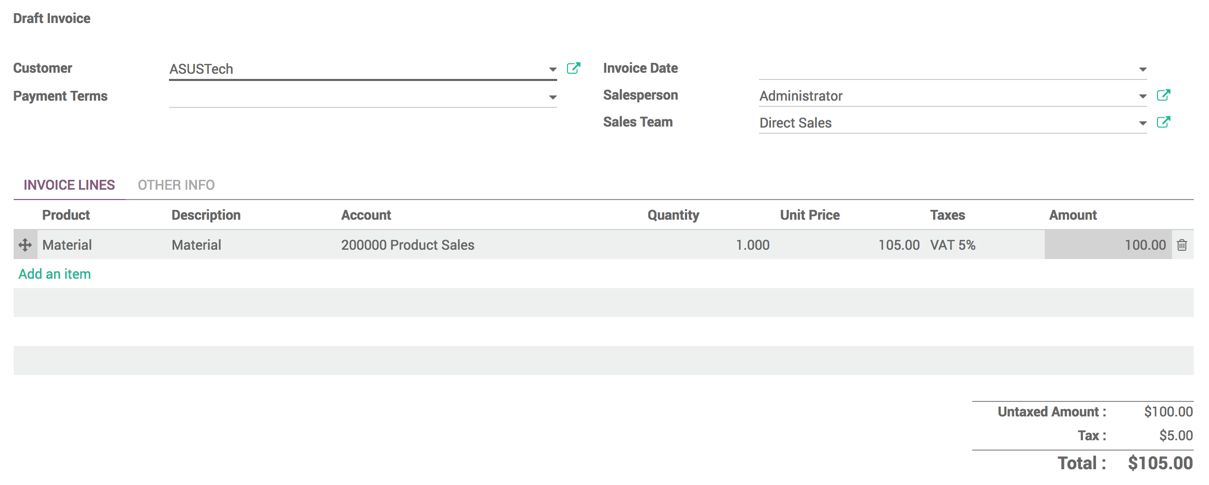

When you create an invoice for amount 105, the tax, which is 5, will be deducted from the product price, and the product price is computed based on this tax deduction, which is 100, as seen in this screenshot: