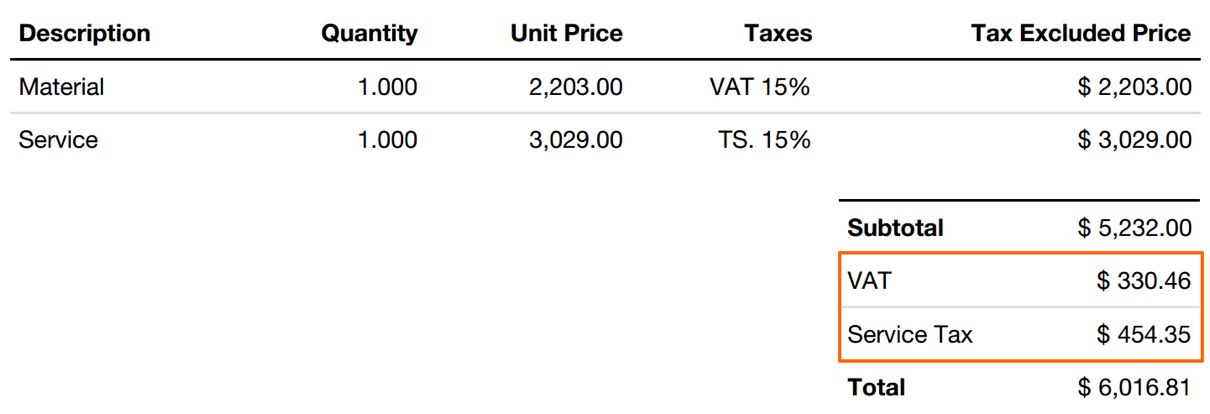

There may be a possibility that while creating a customer invoice, different types of products may have different tax applied may be selected. The tax may have been computed correctly; it is visible on the invoice too. Look at the following screenshot having the products Service and Material with VAT and Service Tax applied on it:

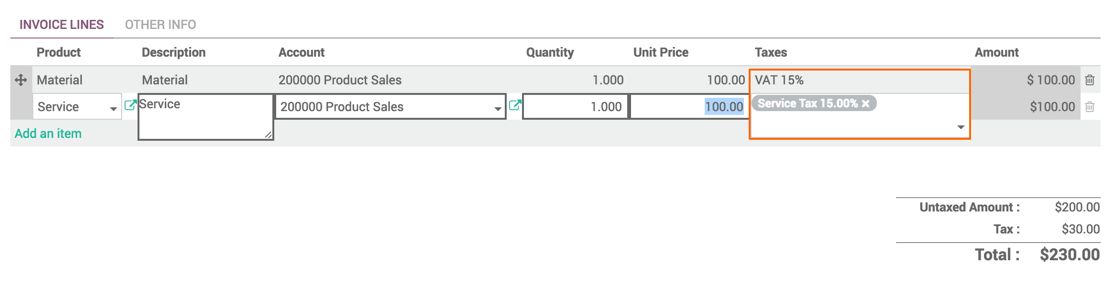

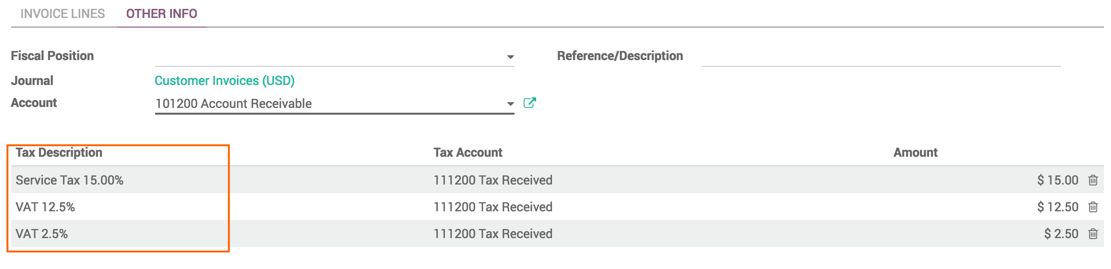

The tax computed on the product and service are correct, the same is visible in the tax lines on the OTHER INFO tab, as seen in the following screenshot:

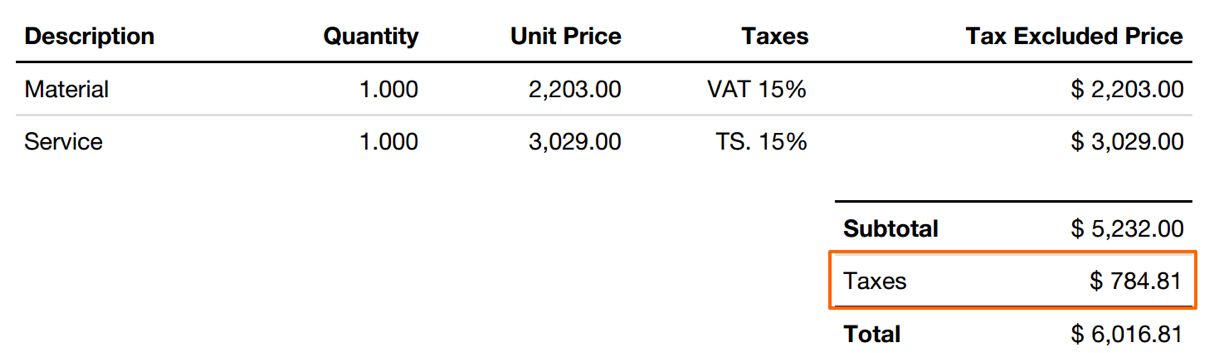

When you print an invoice, it shows the tax computation as correct on the tax lines, but Taxes under the invoice Subtotal create a confusion about the tax applied on the invoice. You cannot have a clear view on what tax is computed, as you cannot see the total Service Tax and VAT. Look at the following printed invoice--under the subtotal, you can see only Taxes:

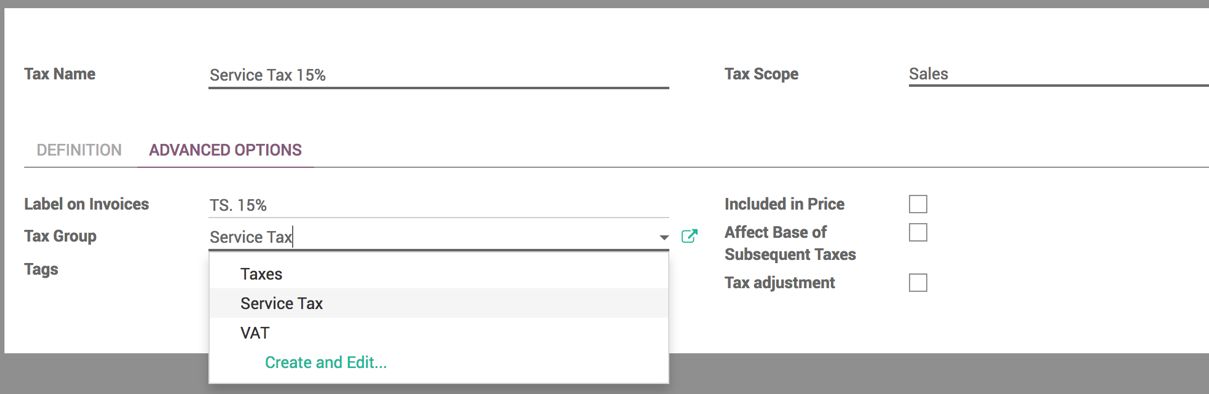

You can create a group for related taxes to separate the tax amount on the invoice. The Tax Group is a field available on the tax configuration part under ADVANCE OPTION. Open the configuration, and change the Tax Group field as shown in the next screenshot for all the VAT taxes (12.5% and 2.5%), and set the Tax Group to VAT. For service tax, create a group Service Tax; look at the following screen for the Tax Group configuration:

Print an invoice and you will get the tax total by the group of tax clearly, as the Taxes field is now divided into VAT and Service Tax, as shown here: