There is more than one tax which may be applicable on some of the products; as soon as you select a product on the invoice, a single tax is applied, but internally it computes more than one tax to maintain the different tax accounts.

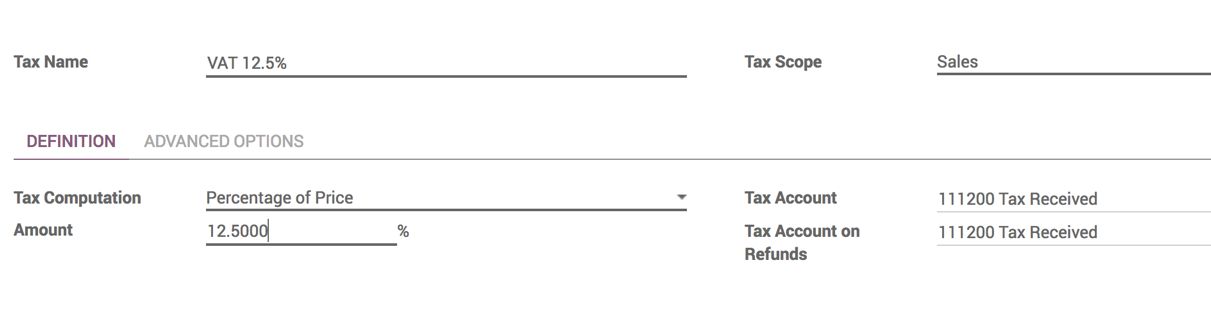

Let's create a new tax, VAT 15%, that will be a combination of VAT 12.5% and Add. VAT 2.5%. Create two separate taxes: VAT 12.5% and Add. VAT 2.5%, as follows:

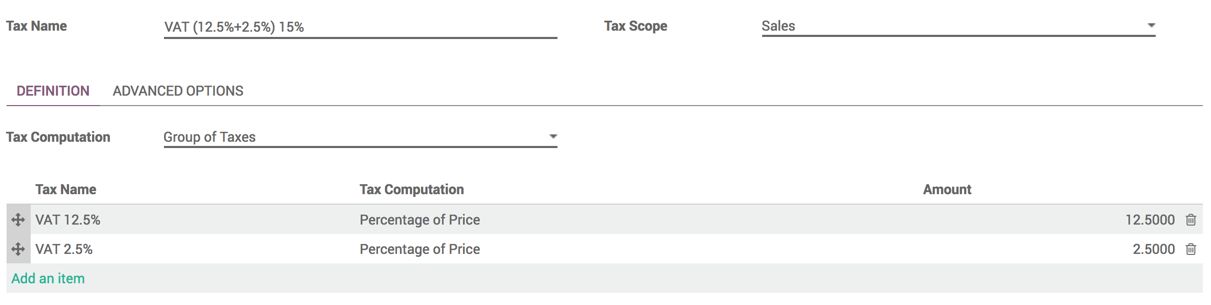

Create Add. VAT 2.5% the same as VAT 12.5%. As soon as you are ready with the two separate taxes, create a group of taxes using VAT and Add. VAT, which is VAT 15%. Create a new tax, select Group of Taxes in Tax Computation, and add the two different taxes, as shown in the following screenshot: