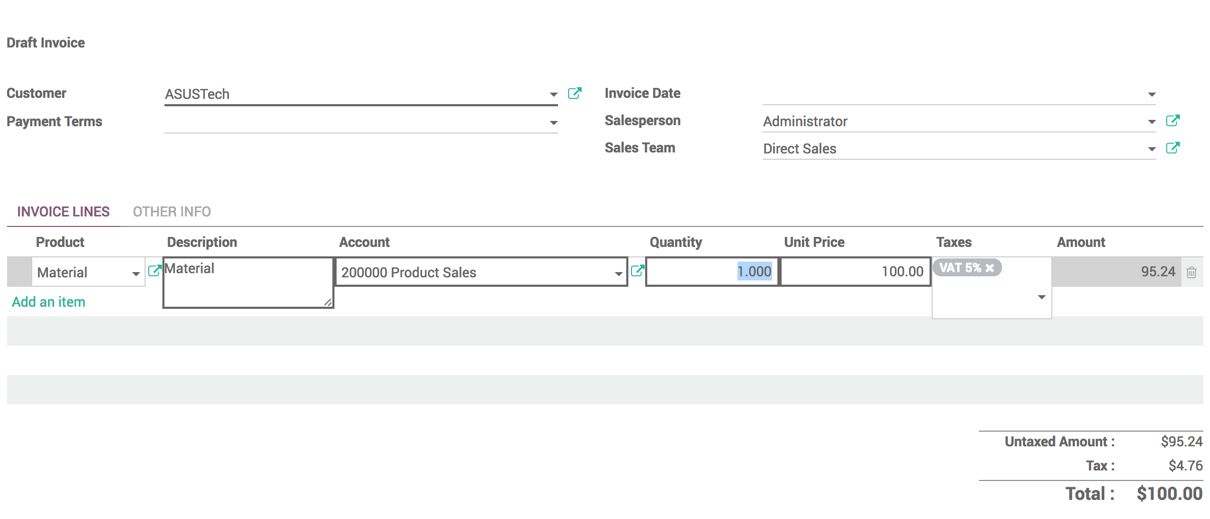

The tax reports will be generated automatically as soon as you confirm the customer invoice or vendor bills:

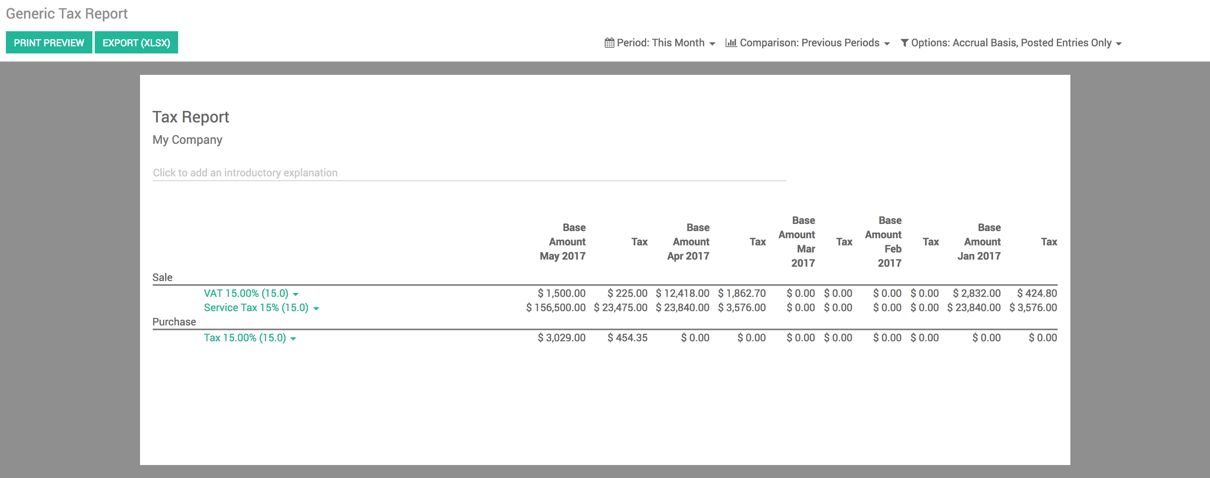

The Tax Report can be accessed from Reports | Tax Reports under the Accounting application.

The Base Amount and Tax values will be displayed on the screen for this month, it can be changed to This Quarter, This Financial Year or Start Date and End date can be applied to the Custom filter.

You can also compare the sales and purchase tax with the last period as well. Look at the following screen for the default tax report:

The period I have chosen is the current month; if you enable comparison with the last four periods, Odoo will automatically select the last four months.

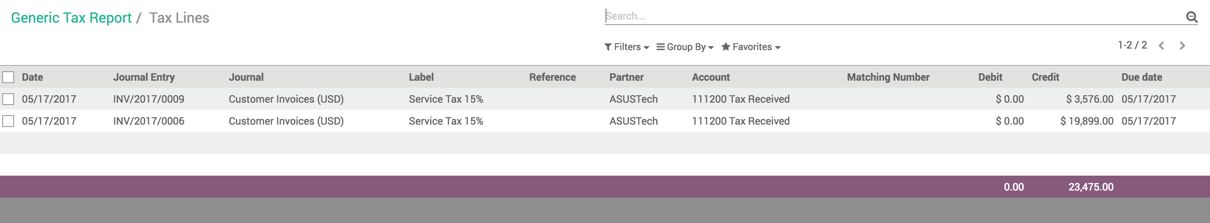

As soon as you click on the drop-down arrow beside Tax, you can analyze the entries behind it. The entries can be a Net amount (base amount based on that the tax is computed) and a Tax amount. If you click on Tax Audit, you will be presented with a list of tax entries created based on the sales transactions, look at the following screen of tax lines:

You can select those entries and export them for further reporting or tax filing.