Make sure that you have created a duplicated database to test this feature. Understand the automatic accounting entries to update the Inventory Valuation and Cost of Goods sold, before configuring it in the production instance.

When the Perpetual (automated) option is set to the Inventory Valuation field for the Product Internal Category, it creates and posts an automatic accounting entry for incoming and outgoing shipments. It also computes the cost of goods sold at the time of validating the customer invoice. It updates the profit and loss account and decreases the inventory valuation.

When the inventory valuation is set to Perpetual (automated), you do not need to create an accounting entry manually, as it will create an accounting entry automatically up on the stock movement. The balance sheet will be updated automatically as soon as we purchase the new material, process the incoming shipment, and confirm the invoice.

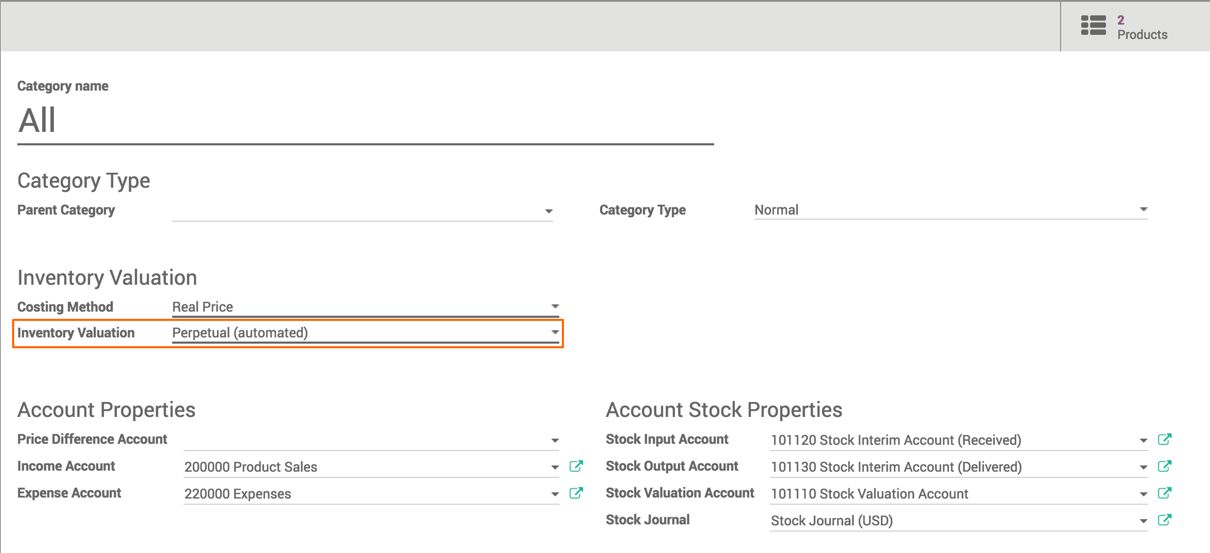

Let's see how Odoo creates automatic accounting entries on each transaction to compute the real-time inventory valuation on the balance sheet. Check the following configuration of the product category before proceeding:

Another option on the product form is Invoicing Policy, which is set to Ordered quantities and Control Purchase Bills is set to On received quantities. The costing method is set to Real price, the accounts for Stock Input, Stock Output and Stock Valuation available under the Account Stock Properties, will be set automatically based on the Chart of Account installed.

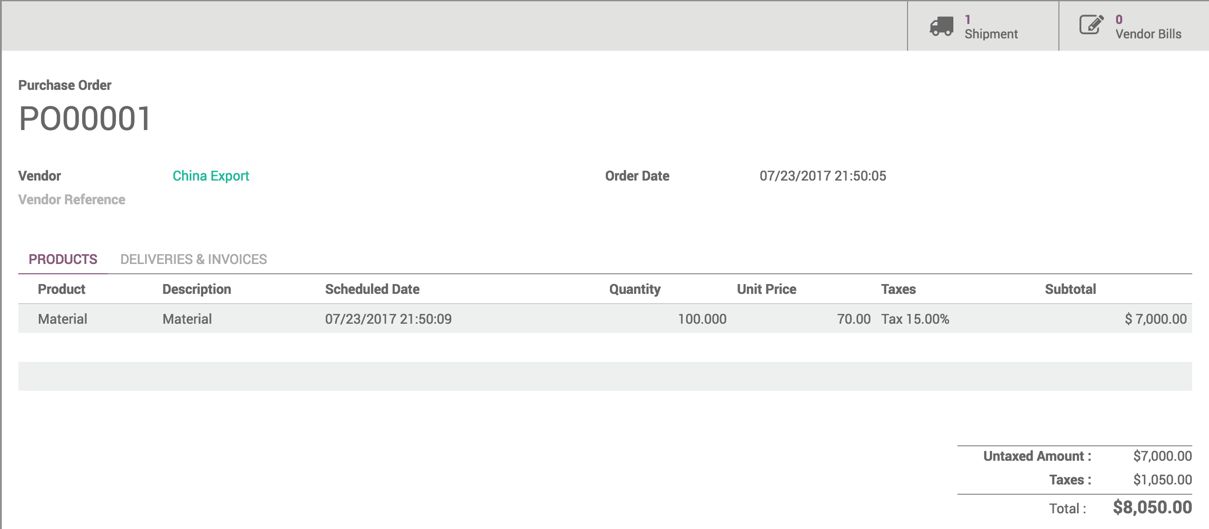

Let's see how the inventory value gets updated upon stock movement. Create and confirm the purchase order. Look at the following screenshot of the confirmed purchase order:

Process the incoming shipment in Warehouse. The accounting entry will be created as soon as the incoming shipment is validated. Look at this screenshot of the accounting entry, created after the validation of the incoming reception:

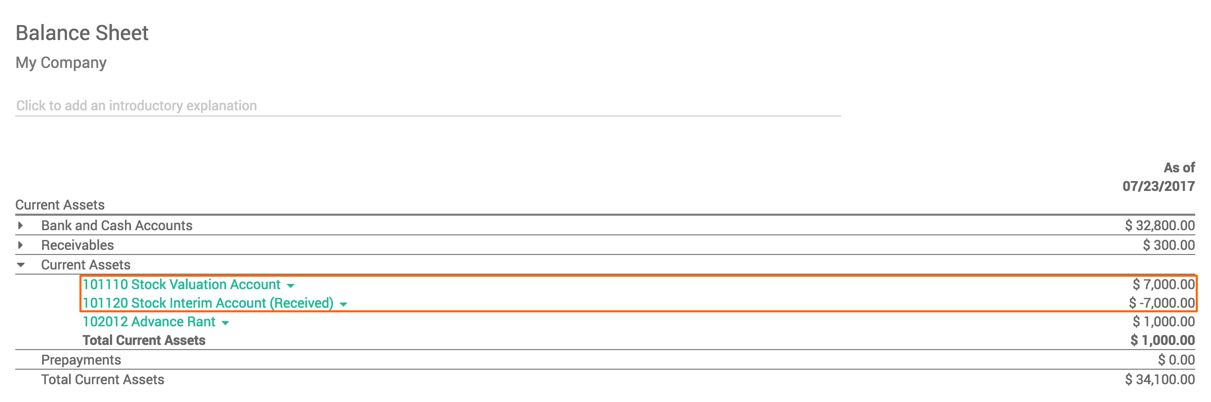

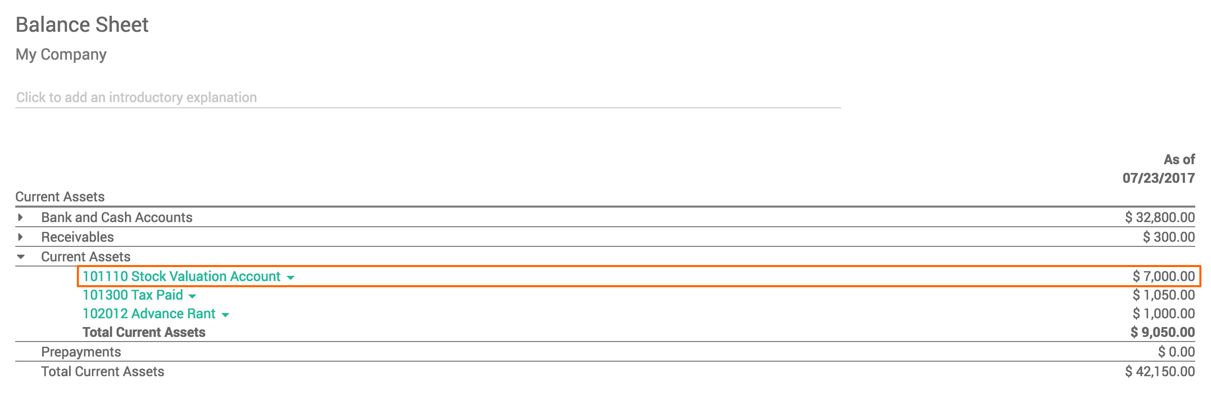

The balance sheet gets updated too. Look at the following screenshot of the balance sheet after the incoming shipment is validated:

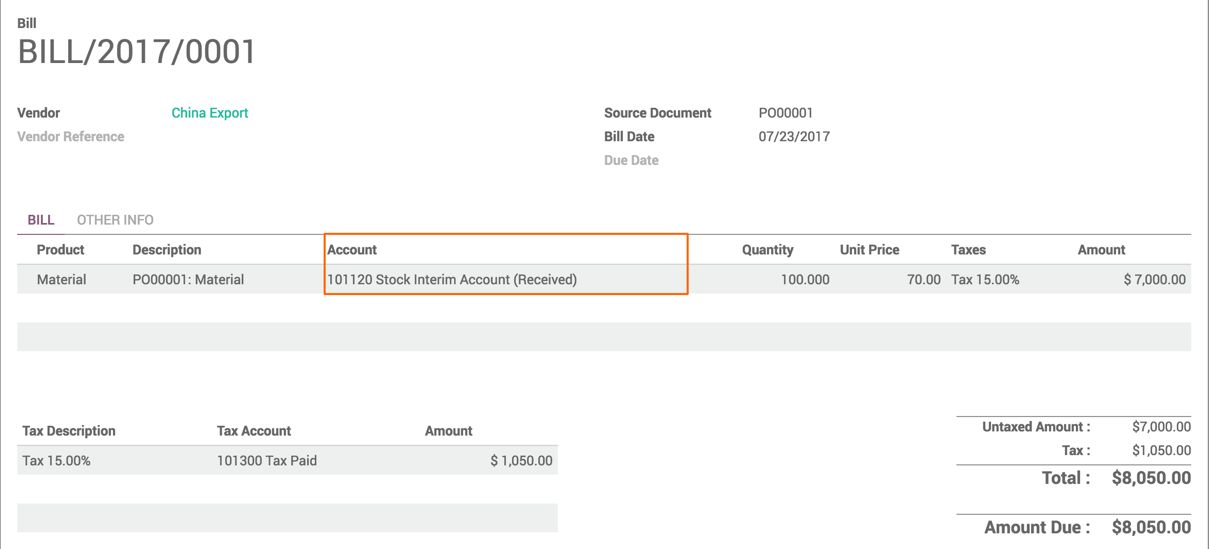

The negative balance on Stock Interim Account (Received) shows that the vendor bill has to be received. As soon as the vendor bill is received, create and confirm the vendor bill. It will debit Stock Interim Account (Received), it will be set to zero, and the payable account will be credited:

Stock Valuation Account remains as it is. Check the Current Asset section under the balance sheet. It will look like this:

Odoo computes the Cost of Goods Sold at the time of creating a customer invoice.It will decrease the inventory valuation by that price and update the balance sheet.

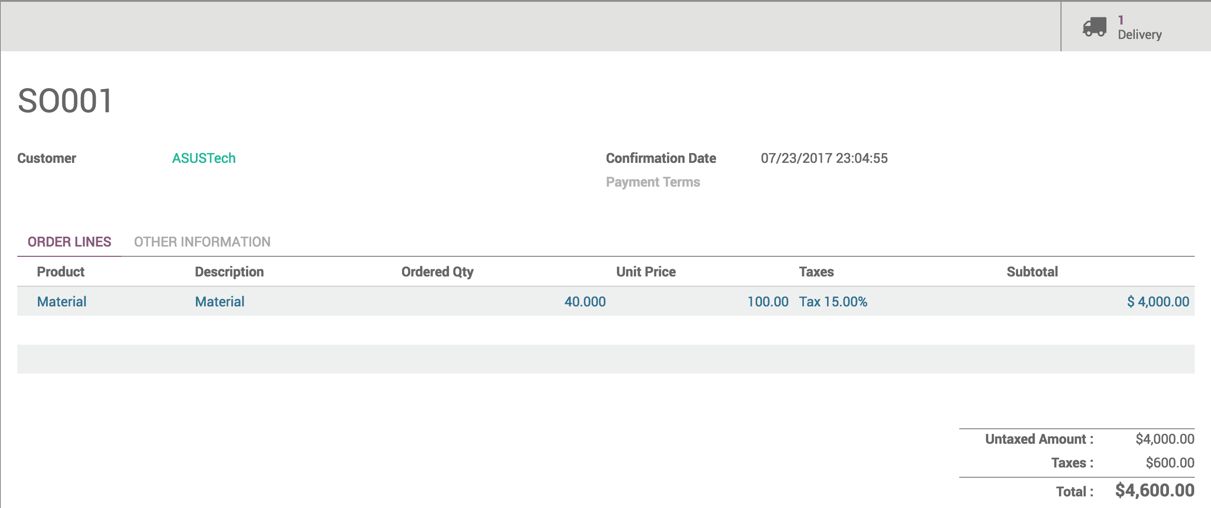

Create and confirm the sales order for a quantity of 40 Material at the rate of 100:

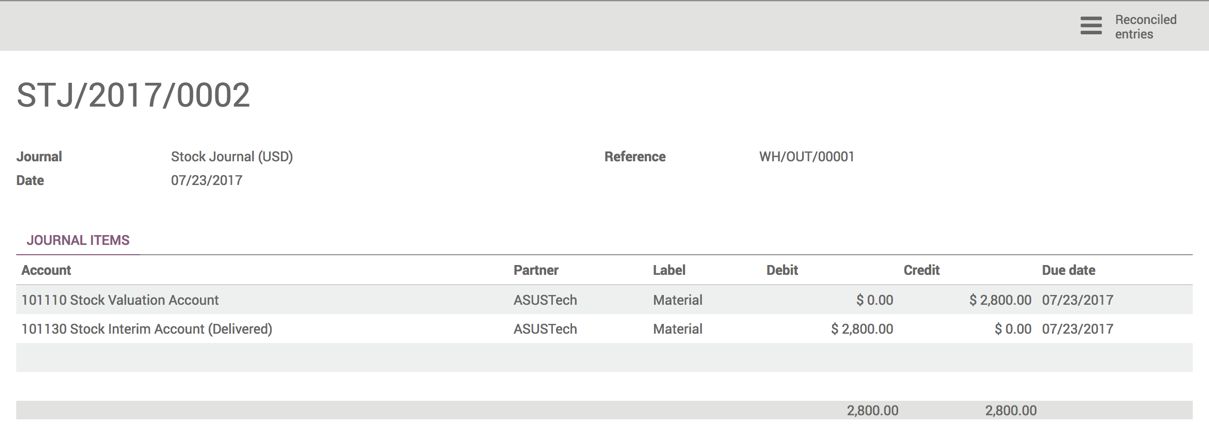

Process the delivery order in Warehouse. As soon as the delivery order is processed, it will create the following accounting entries based on the stock movement in the Warehouse:

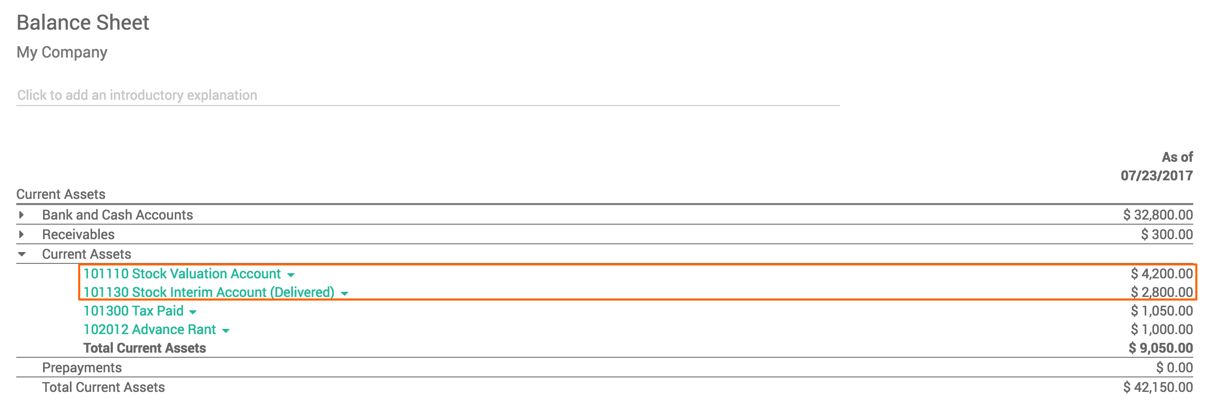

The balance sheet will get impacted after the delivery order is processed. It credits Inventory Valuation Account and debits Stock Interim Account (Delivered):

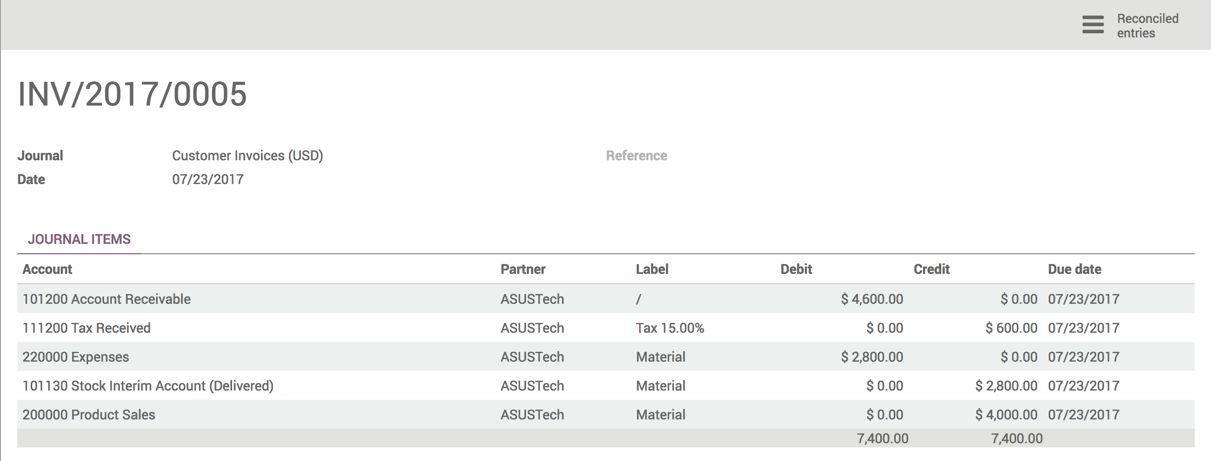

The positive balance on the Stock Interim Account (Delivered) shows that the delivery was processed but the customer invoice has not been prepared yet. Let's create and confirm the customer invoice. It will create the following accounting entry as soon as the invoice is confirmed:

The sales will be credited and the customer receivable account will be debited. Also, it computes the cost of goods sold and creates the accounting entry for the cost of goods sold.

The Stock Interim Account (Delivered) will be credited, and the Cost of Goods Sold will be debited. Look at the Profit and Loss account displayed on the screen, as shown here:

The Perpetual (automated) method does automatic accounting entries. So, no need to do periodic accounting entries, as it will be done automatically.