Make sure that you have created a duplicated database to test this feature. Understand the automatic inventory valuation computation, and manual accounting entries before configuring these in the production instance.

The default option set for the inventory valuation is Periodic (manual).It refers to the manual accounting entries for the books of accounts on periodic intervals. The Inventory valuation is recomputed in Warehouse on every incoming or outgoing shipment.Every time you check the inventory valuation, you will get the latest inventory value. The inventory valuation has to be checked at regular intervals, that is, weekly, monthly, quarterly, or yearly, and the profit and loss account has to be updated manually for the cost of goods sold.

The balance sheet can be updated automatically as soon as we confirm the invoice for the purchase order.

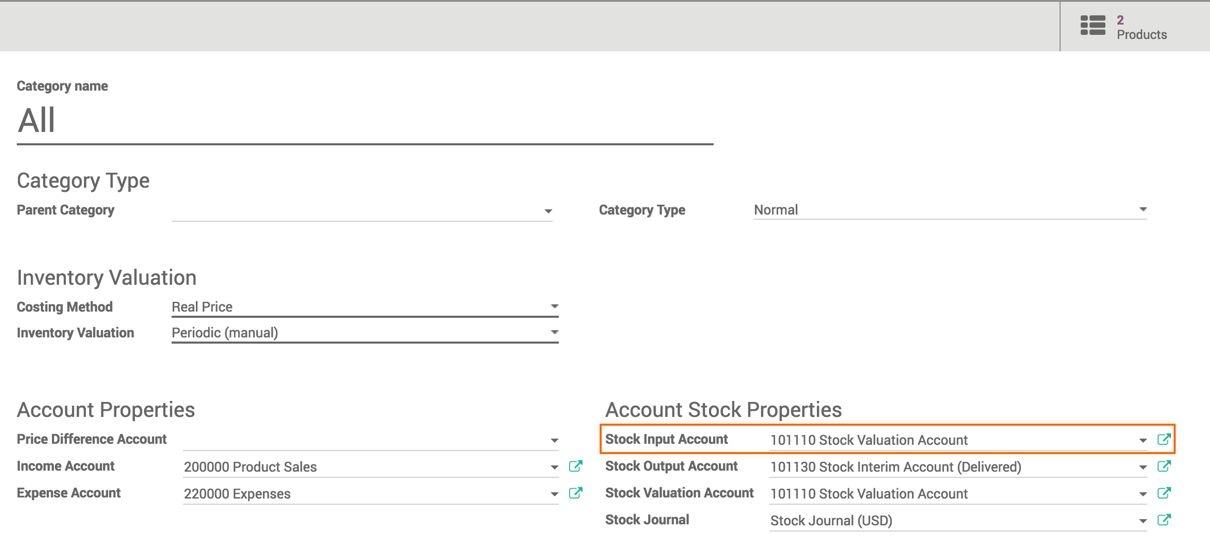

Configure the product internal category before proceeding further. Set the account to 101110 Stock Valuation Account for Stock Input Account instead of 101120 Stock Interim Account (Received). When inventory valuation is set to Periodic (manual), only the Stock Input field account is required.

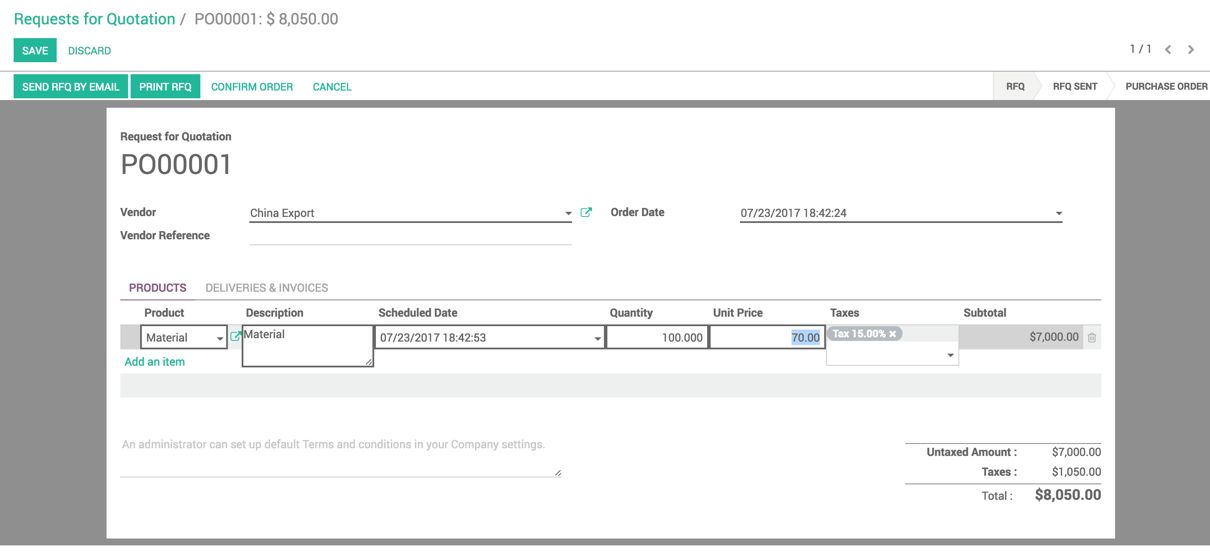

Configure the other options on the product form such as Control Purchase Bills. It should be set to On received quantities. Create a purchase order and buy a quantity of 100 Material from China Export at the rate of 70. Look at the following screenshot of the purchase order:

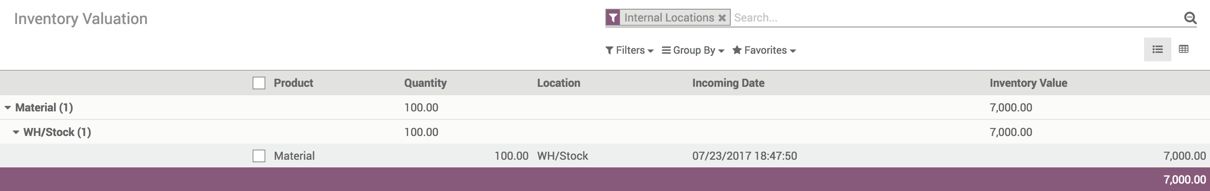

Confirm the order and process the incoming shipment at the reception.As soon as the incoming shipment is processed, the inventory will be updated in Warehouse and the Inventory Valuation report will be updated too. Look at this screenshot of the inventory valuation report:

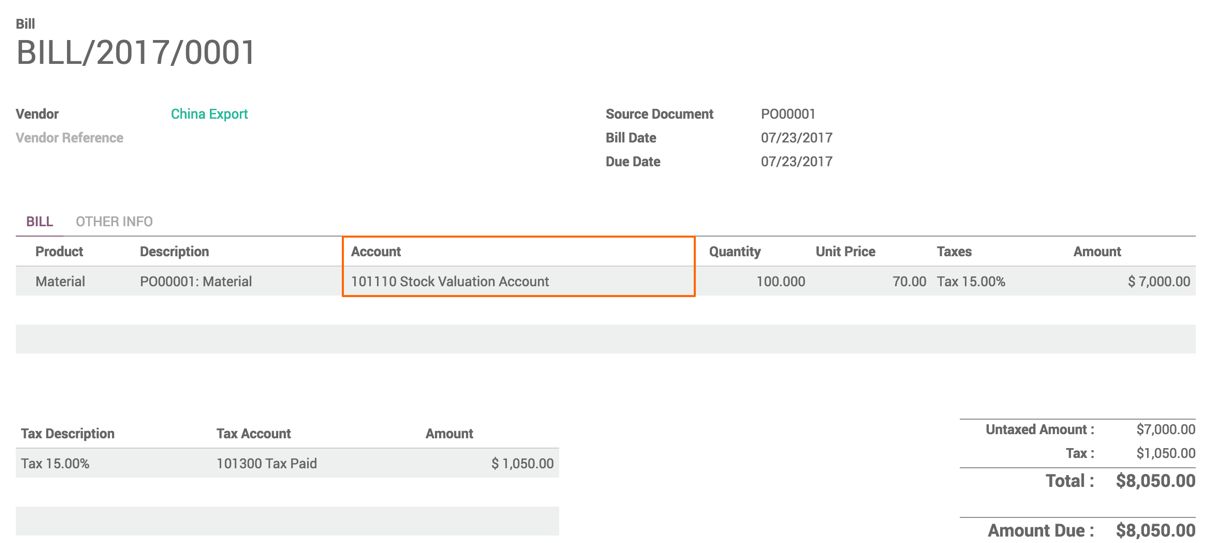

Create a vendor bill as soon as you receive it from the vendor. Look at this screenshot:

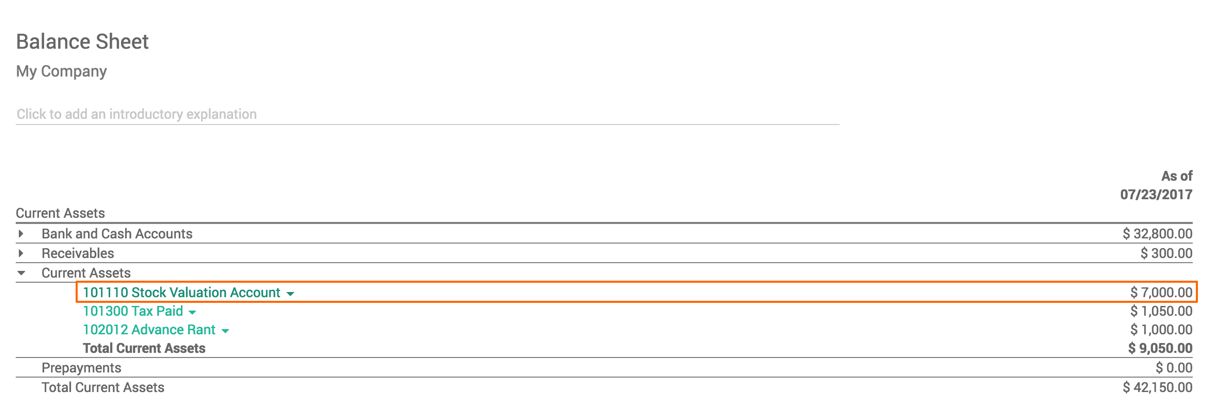

Confirm the vendor bill.The balance sheet will be updated as soon as the vendor bill is validated. The Stock Valuation Account will be debited and the vendor payable account will be credited, instead of debiting the cost of goods sold account. As the stock valuation account belongs to the balance sheet, the balance sheet will be updated when the vendor bill is validated. Look at this screenshot of the balance sheet report:

The total of the inventory valuation report and stock valuation on the balance sheet should have the same amount. The stock valuation will be updated automatically for every purchase after receiving and validating the vendor bill.

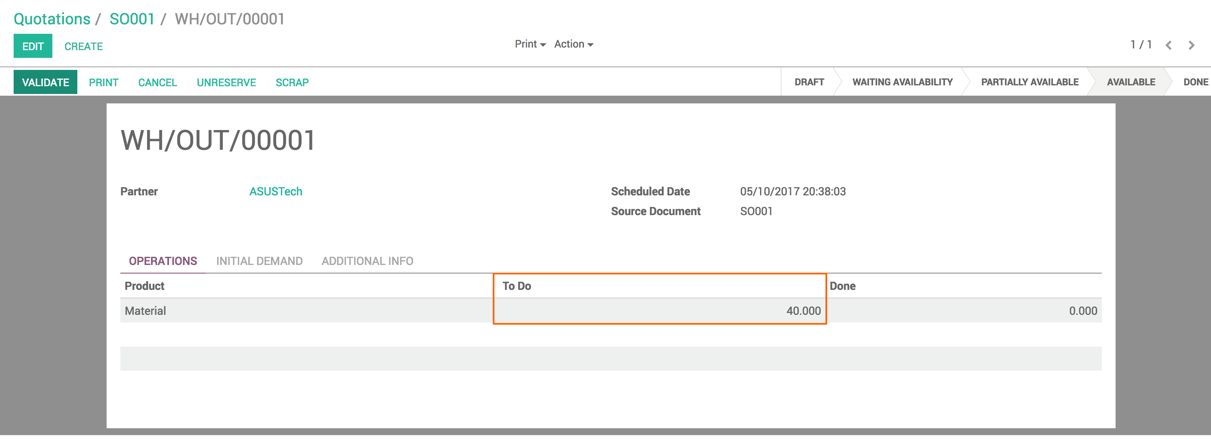

Let's assume that we have a delivery to process the sales order and we have to deliver a quantity of 40 Material from the Warehouse:

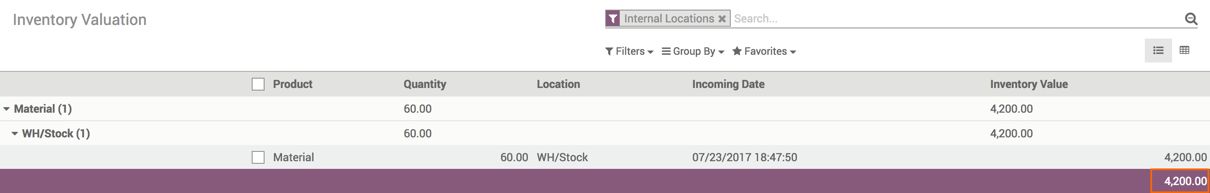

VALIDATE the delivery order; this will assign the quantity of 40 Material from the Warehouse.The quantity decreases from the Warehouse. It will decrease the inventory valuation too. Look at the report; it will look like the following screenshot:

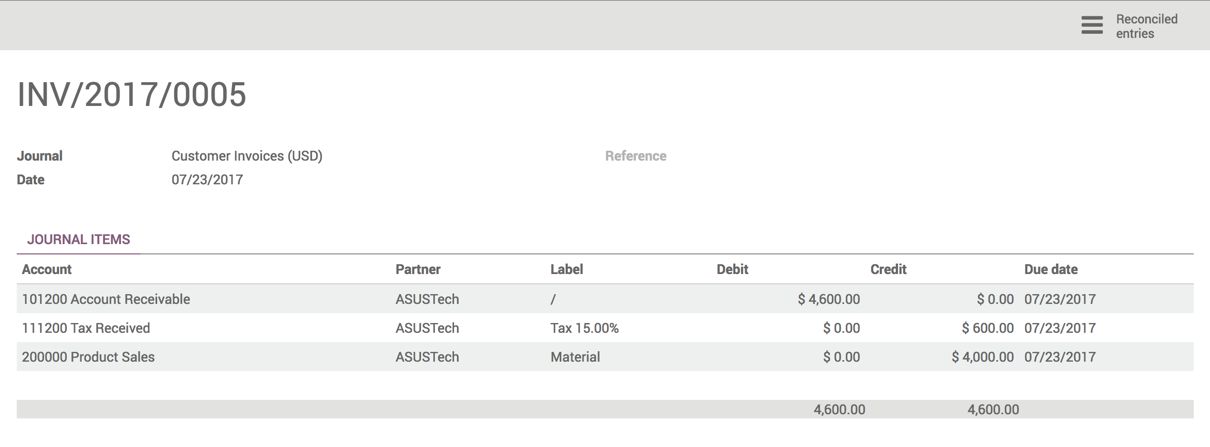

As the delivery is completed, we can create and confirm the customer invoice. On invoice confirmation, it will create the following accounting entry in the book of accounts:

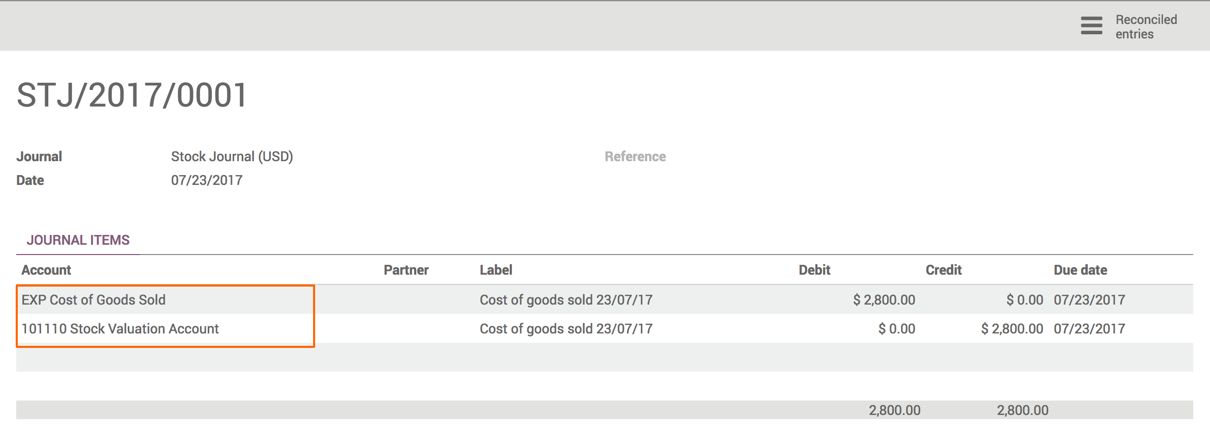

This will not affect the inventory valuation.The inventory valuation on the balance sheet has to be updated manually as we choose to update Periodic (manual). Look at the following accounting entry that actually updates the Inventory Valuation account and the Cost of Goods Sold account, the inventory valuation registers the cost of goods sold, the value will go down, and it will be registered as an expense:

The value of Cost of Goods Sold can be computed using this formula:

Cost of goods sold (2800) = Stock Valuation Account (balance sheet, 7000) - Value on the Stock Valuation report (4200).

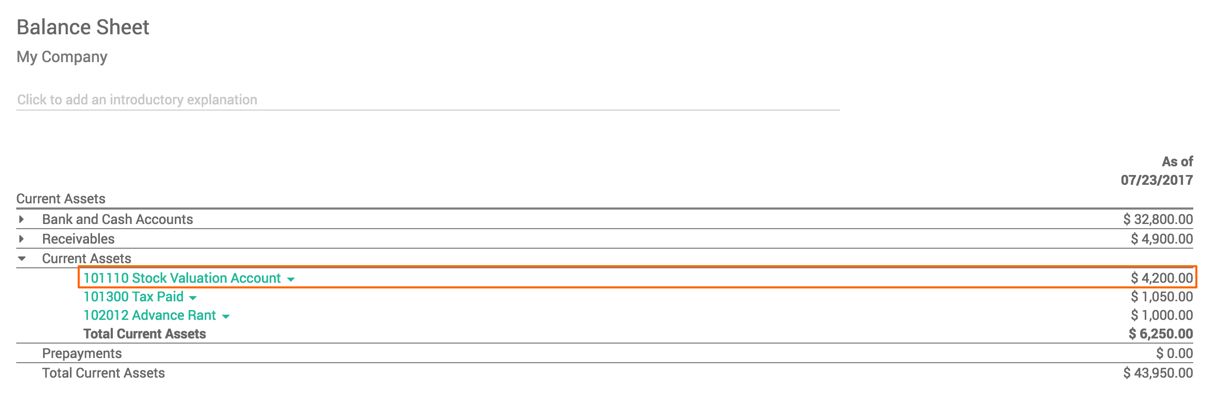

Post the accounting entry and the balance sheet and profit and loss accounts will be updated accordingly. Look at the following screenshot of the balance sheet report:

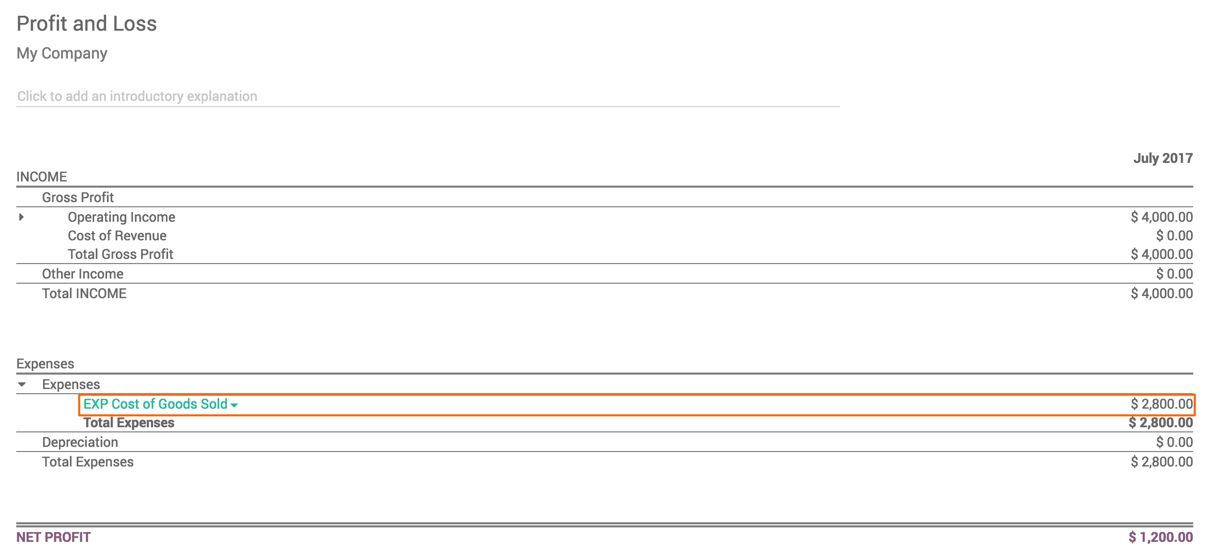

The Profit and Loss account is updated with the Cost of Goods. Look at the Profit and Loss account report here:

Every time, on the confirmation of the vendor bill, the inventory valuation will get increased. The cost of goods sold has to be computed manually at regular intervals and pass an appropriate accounting journal entry to update the Balance Sheet for the Inventory Valuation account and Profit and Loss statement for the Cost of goods sold account. That's why it's called the Periodic (manual) method.