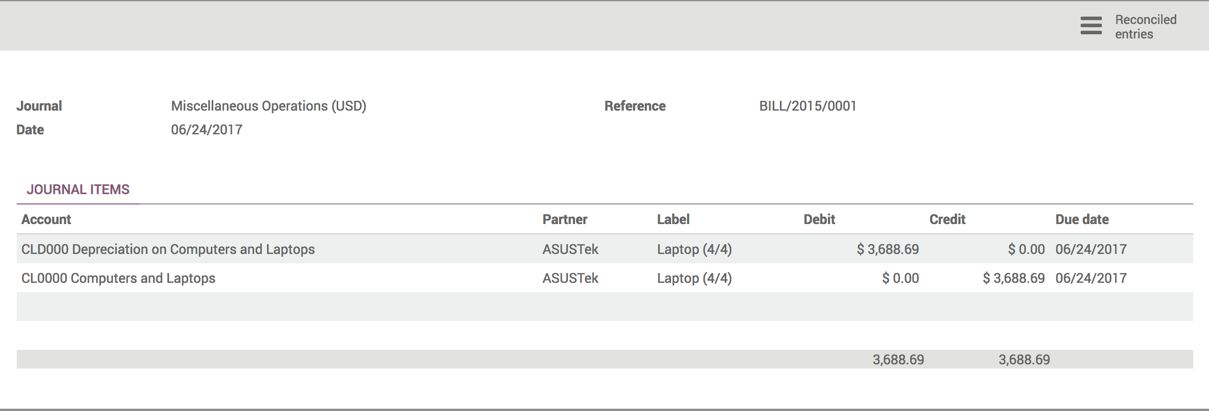

An asset can be scrapped at the end of its life, or it can be resold before the end of its life. We can mark an asset as scrapped or sold by clicking on the SELL OR DISPOSE button. Clicking on the button will create a depreciation accounting entry for the residual amount, as shown in the following screenshot:

The residual value is the value of assets as per the books of account. It can be sold either at a higher or lower price than the residual value. If we succeed with selling at a higher price, we may gain a profit, or, if we sold at a lower price than the residual value, we may incur a loss. Let's assume that we sold all the laptops at the value of $3,000 before the end of life. We made a loss of $688.69 as we get less amount compared to its residual value:

This loss has to be entered at the time of selling the assets. Look at the preceding screenshot. I have changed the accounting entries for the loss, and for receiving cash and a loss.