Depreciation is computed in advance at the time of configuration of vendor bills, based on the computation method applied to the asset type. An accounting entry will be posted automatically to decrease the value of the asset and write the depreciation expense on the profit and loss account.

Every year, the value of the asset will decrease, as you can verify from the Balance Sheet report. Open the balance sheet report and compare with the previous years. You will find that this year the value has decreased by 30 percent compared to last year, in my case:

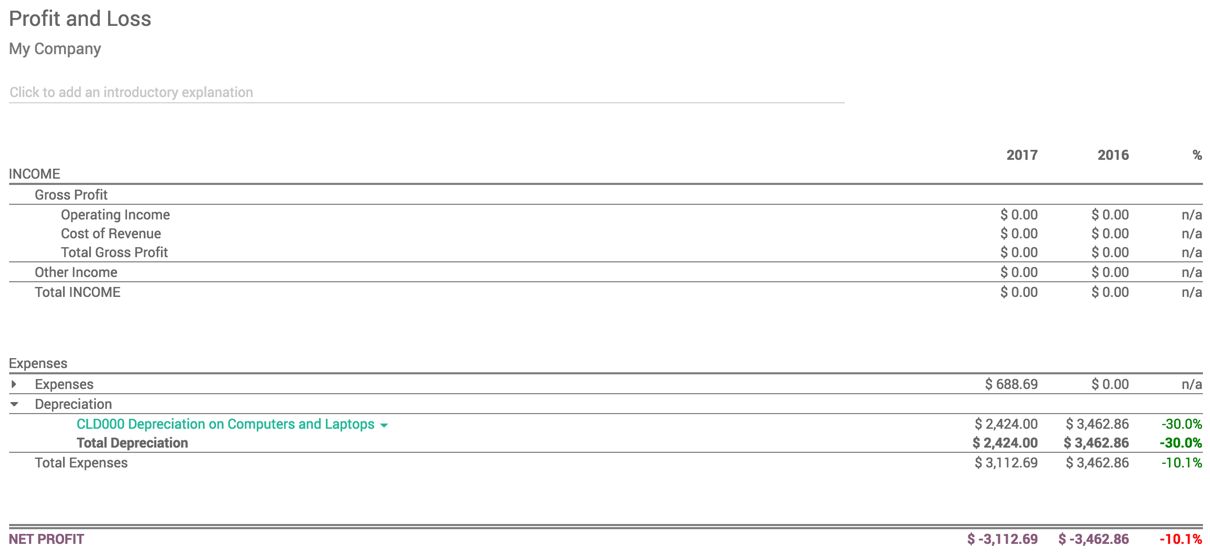

As with the balance sheet, open the profit and loss account and compare it with the previous year. The depreciation value would have gone down by 30 percent compared to the previous year. Look at the following report of the profit and loss account: