Depending on the type of business, you need a tax registration to collect the tax and the account (ledger) has to be maintained for such taxes. The tax payable has to be computed at a specific interval and paid to the government regularly. In such cases, the taxes have to be created and configured correctly to maintain the tax ledger.

Assume that some of the taxes are not having the tax registration account for those taxes it is not compulsory to maintain the tax ledger as we are not going to get the input tax credit in such case. Odoo allows you to manage those kinds of taxes manually on the vendor bills instead of creating those taxes.

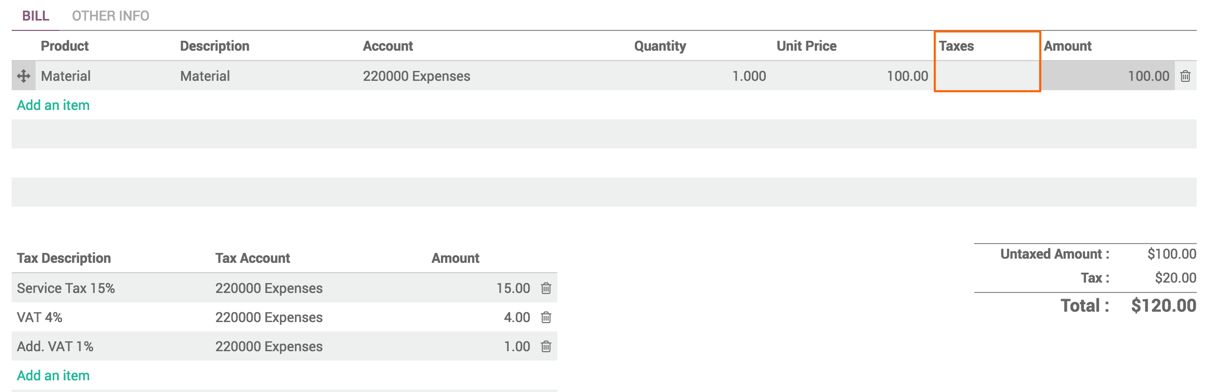

On the vendor bills, the taxes can be entered manually by creating a tax line below the bill lines. Click on Add an Item, enter the description, select the account (usually, it's the same account), then select expense on the bill line, and simply enter the tax amount. Look at the following screenshot for reference:

You can see that Taxes are not applied on the bill line; the taxes lines are created manually, with Tax Description, Tax Account, and Amount.