Usually, cash discounts are given to customers who clear their payment on or before the due date. The cash discount policy helps a lot to maintain cash flow in a business. For example, normally, a 2 percent cash discount is given if a customer clears the payment within a week, otherwise, the customer can pay within 30 days from the date of the invoice. So, you should be able to identify whether the customer eligible for a cash discount now; is eligible, you can process the bank reconciliation with the cash discount.

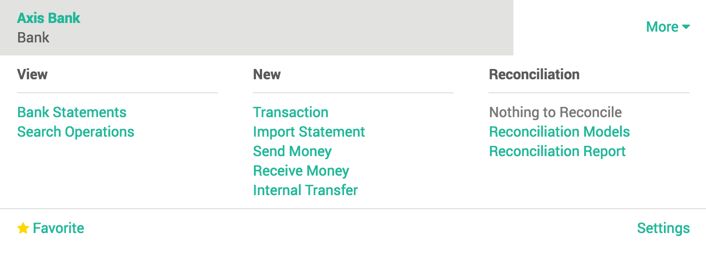

The reconciliation model can help you to speed up the process. You can create a reconciliation model from Accounting Dashboard: click on the More link for the bank where you want to allow the cash discount and choose Reconciliation Model to create a new reconciliation model:

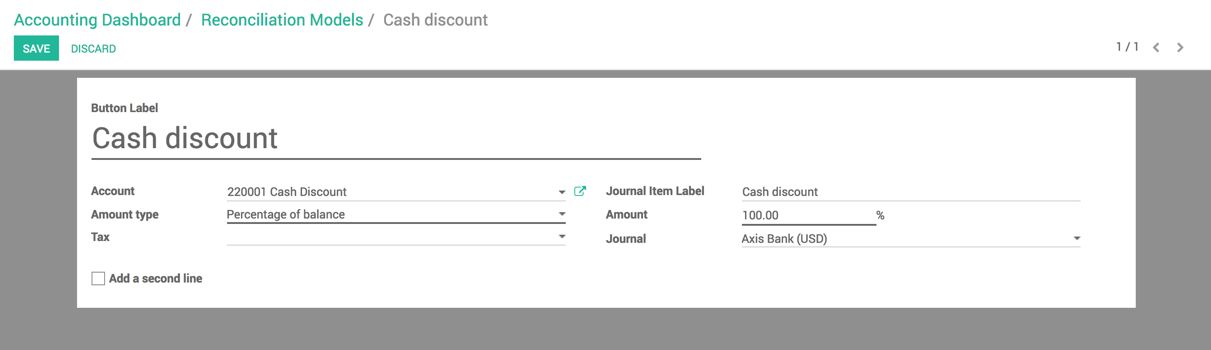

The steps to create a cash discount model are as follows:

- Create a new model for cash discounts as follows:

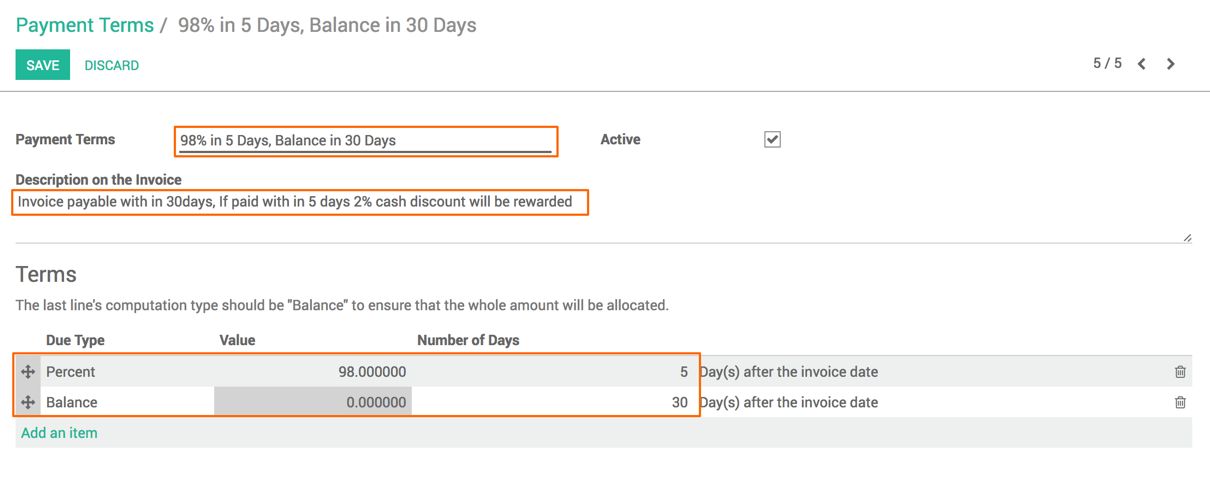

- Before creating an invoice, let's create the payment terms to attach to the invoice. Please go through the recipe Customer invoice and payments from this same chapter to create payment terms. The payment terms created looks like the following screenshot:

- To make it clear that it's not a payment term but a cash discount, don't forget to set a clear description that will appear on the invoice.

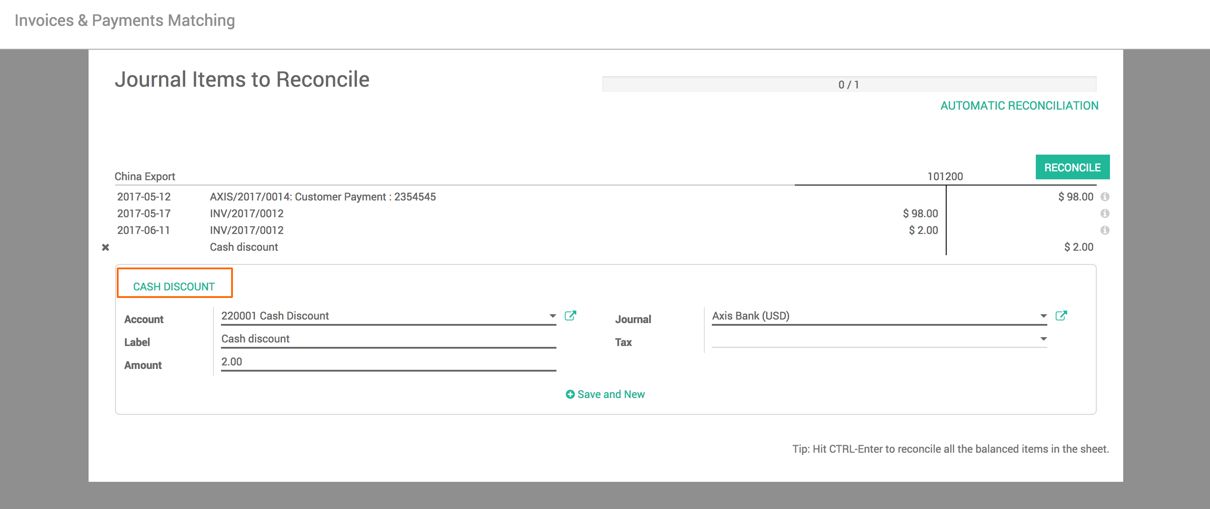

- Let's create an invoice for China Export of 100, attach the payment term, and create a payment to encode the check received from the customer having the value 98.

- Go to Manual Invoices & Payments Matching, you will get the payment line and invoice line with 98 matched for China Export. Select the remaining invoice line with 2, and add a new line by clicking on the CASH DISCOUNT button on the counterpart:

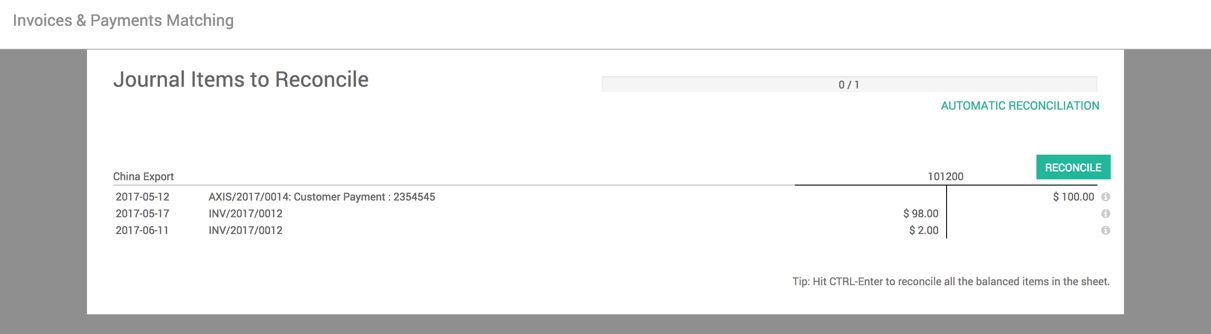

- If the customer pays the invoice after five days, where a cash discount is not applicable, you can still reconcile the payment line of 100 with two invoice lines 98 and 2, as displayed in the following screenshot:

The Reconciliation Model can be used for many different purposes, for example, deduction of TDS can be configured with the Reconciliation Model.