The payment term is a time period that is used to define and calculate payment instalments and their respective dates, that is, 50 percent in advance and the balance in 30 days means that the customer has to pay 50 percent on confirmation of invoice and the remaining 50 percent within 30 days from the date of invoice.

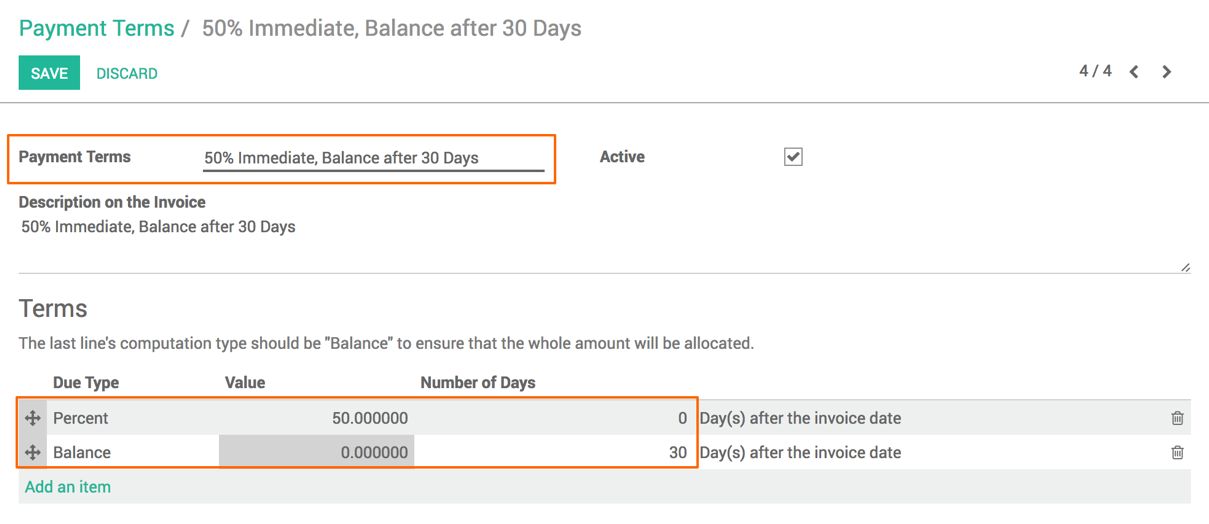

The payment terms can be created from Accounting | Configuration | Management | Payment Terms. You will see the default payment terms available: 15 Days, 30 Net Days, and Immediate Payment. Let's create a new payment term, 50% Immediate, Balance after 30 Days; click on the CREATE button:

Enter 50% Immediate, Balance after 30 Days in the Payment Terms. Enter clear payment terms information in Description on the Invoice; it will be visible on the invoice.

There is a default line with the label Balance, Value is 0.0000, Number of Days is 0, Day(s) after the invoice date. Click to edit the default line to label Balance, keep Balance selected in Type, and enter 30 in the Number of Days field. The last date will be computed based on this line to clear the full payment.

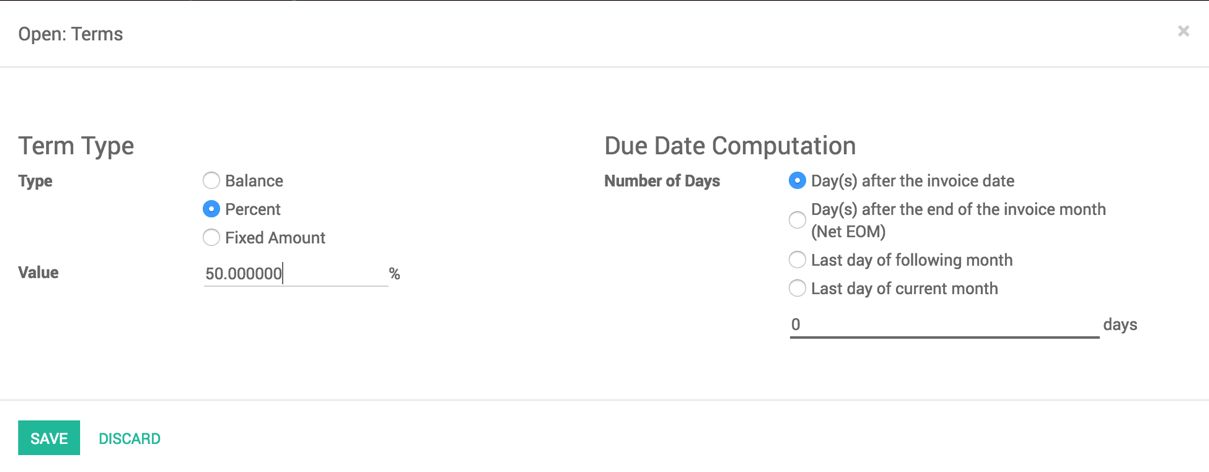

To compute the date for 50 percent immediate payment, let's create a new line; by clicking on Add an item. A popup will appear as follows:

Select Percent in the Type section set it to 50.000000% in the Value field, keep the option Day(s) after the invoice date selected for Number of Days, and 0 in days. Click on SAVE to create a new line:

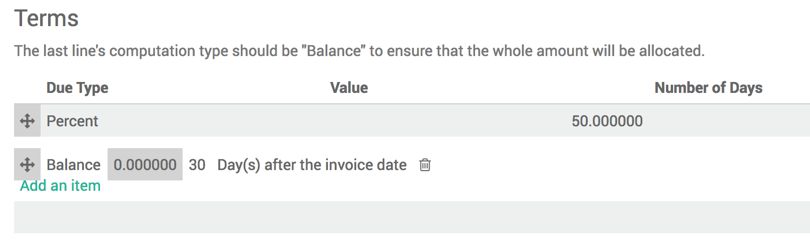

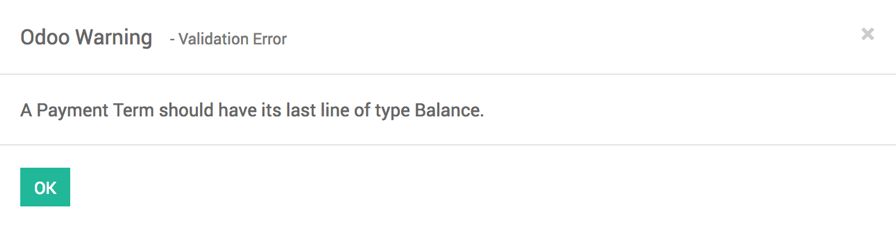

The new line will be added after the Balance line. When you try to SAVE you might get a warning message as follows:

Use the sequence handler to arrange the order of the payment terms line, and save Payment term.

The payment term is ready to use; you can set this payment term on the customer, or directly use it on the invoice; let's check how this works. Create an invoice and select the payment term. Change the Invoice Date to 1st May 2017, and confirm the invoice.

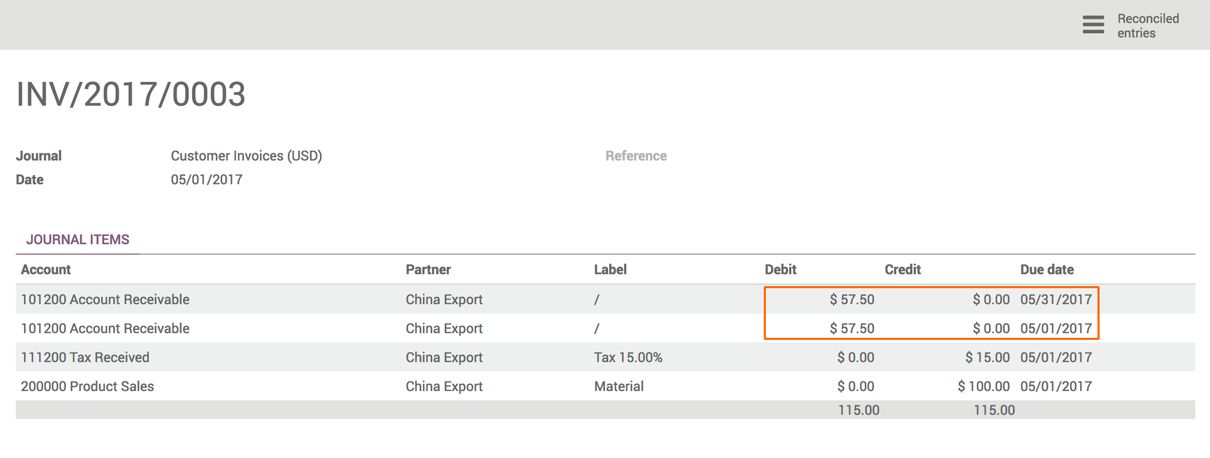

As soon as you confirm the invoice, the accounting line will be created with respect to the payment term selected on the invoice. It computes two installments with their due dates to clear the payment base on the invoice date, that is, 1st May 2017. You can go to the accounting entries linked to the invoice from the OTHER INFO tab:

Click on the Journal Entry link INV/2017/0002; you will be directed to the journal entries created for the invoice, as seen in the following screenshot:

A total sum of 115 $ is receivable from the customer, where 50 percent of the amount should be paid on the same day of generating the invoice, and 50 percent within 30 days.