Книга: Английский язык. Практический курс для решения бизнес-задач

Назад: Essential Vocabulary

Дальше: Summary Valuation of Aeroflot

Lesson 34

Equity Research Report

Read and translate the text and learn terms from the Essential Vocabulary.

Aeroflot: Taking Off

– Aeroflot, Russia’s leading airline, offers attractively valued exposure to strong GDP growth in Russia and increasing disposable incomes.

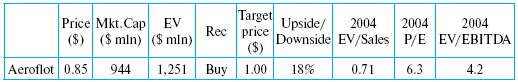

– We raise our target price for Aeroflot by 42% from $0.7 to $1.0, following the publication of unaudited 9MO3 IAS financials that demonstrated better cost control and working capital management than forecast, and slightly higher than expected revenue growth. We upgrade our recommendation from Hold to Buy.

– If valued at our new target price of $1.0, Aeroflot would still trade at significant discounts to emerging market (EM) and developed market (DM) peers – 48% and 49%, respectively, on 2004 P/E, and 42% and 18% on 2004 EV/EBITDA.

– Aeroflot’s operating performance in 2003 showed resilience to the negative global air transport environment caused by SARS and the war in Iraq. We expect profits of more than $10 million for Aeroflot in 2003, while most DM airlines are expected to report losses.

– Aeroflot will have a new fleet of 27 foreign aircraft – 18 Airbus and 9 Boeing – by year-end 2004. The rationalization of aircraft types in the fleet will reduce maintenance costs and make the company more competitive among foreign peers on international routes.

– Larger Airbus models along with six new IL-96 aircraft will by year-end 2004 boost Aeroflot’s passenger capacity by 17.7% versus 2003, to 29.1 billion available seat kilometers (ASK).

– The company will strengthen its market position relative to domestic competition when it upgrades its fleet of regional aircraft, while grounding outdated aircraft.

– We introduce upgraded projections for Aeroflot’s financials through to 2010 based on 9MO3 unaudited IAS financials and full-year 2003 operating data produced by the company in mid-January.

– Given the recent performance of Aeroflot’s shares, which have gained 44% on a 3-month basis – outperforming the local market by 29% – we see the upside for Aeroflot shares over the next few months being limited to 20%.

Назад: Essential Vocabulary

Дальше: Summary Valuation of Aeroflot