Книга: Английский язык. Практический курс для решения бизнес-задач

Назад: Essential Vocabulary

Дальше: On the Valuation of Russian Equities

Lesson 33

Valuation of Russian Companies

Read and translate the text and learn terms from the Essential Vocabulary.

Company Handbook

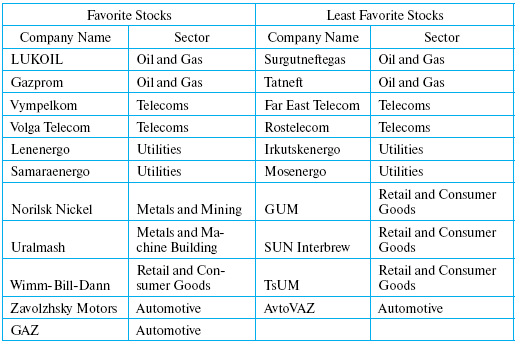

Figure 1. Renaissance Capital Stock Focus List

Recap of Stock/Sector Performance Year-to-Date

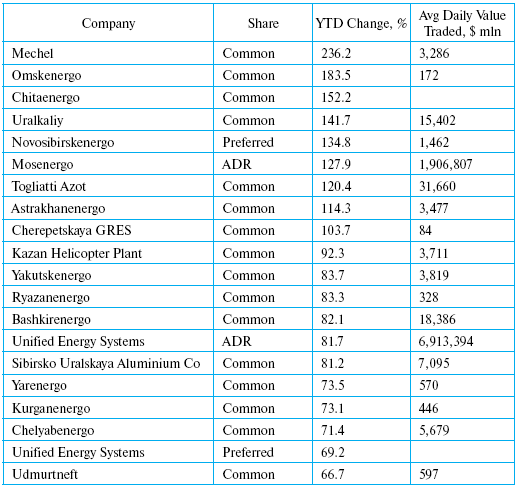

Driven by the ever growing domestic liquidity, the Russian stock market has risen strongly over the year, gaining 26%. The top performers in 2003, similar to in 2002, were second– or even third-tier stocks. The only two «blue chips» to feature in the top 20 best performing companies – Mosenergo and UES – almost doubled in value year-to-date (this is a stark reversal of the situation in 2002 when each of these stocks lost about 25%). 75% of the top 20 best performing stocks come from the utilities sector, implying that the game for control of the sector, which started in 2002, is still on.

Figure 2. The Best Performing Russian Stocks in 2003 Year-to-Date

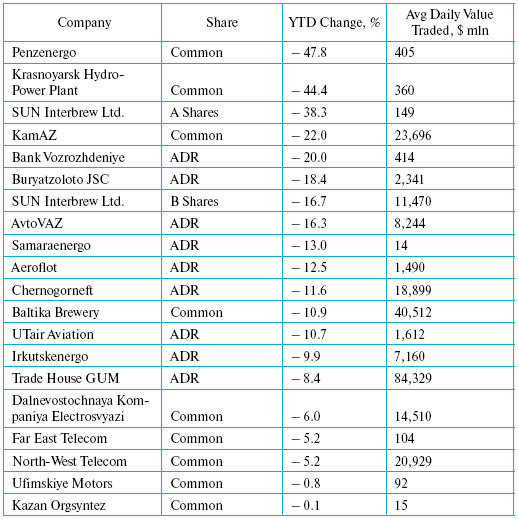

The list of the worst performing stocks has 4 utilities firms in 2003, but otherwise it is a more diverse group and contains a number of larger companies. Beer stocks were clearly out of favor with investors, with SUN Interbrew falling almost 40%, and Baltika down 10%. Despite the strong rally in the telecoms sector as a whole, two stocks – Far East Telecom and North-West Telecom – lagged behind their peers.

Sector performance is something of a misnomer, as several are comprised of just one or two companies, while others include common and preferred shares, which often distort the overall picture. The banking sector (that is, Sberbank), which was the best performer in Russia in 2002, managed to clinch the second spot in 2003 year-to-date. The utilities sector, which was the only sector that finished down year-on-year in 2002, was the best performing one year-to-date, helped by hefty increases in UES and Mosenergo shares. At the other end of the spectrum were the airlines, and the retail and consumer stocks (led down by SUN Interbrew’s and Baltika’s poor performances).

Figure 3. The Worst Performing Russian Stocks in 2003 Year-to-Date

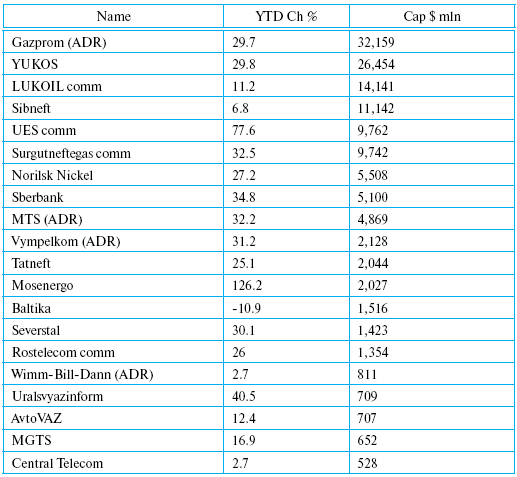

Finally, all top 20 stocks, except Baltika, have increased in value since the beginning of the year. UES moved up from the middle of the table at the beginning of 2003 to become the 5th largest stock. Following a strong rally in the telecom sector, 6 of the top 20 Russian stocks were telecom companies.

Figure 4. Performance of the Top Russian Stocks in 2003 Year-to-Date

Назад: Essential Vocabulary

Дальше: On the Valuation of Russian Equities