Книга: Английский язык. Практический курс для решения бизнес-задач

Назад: Auction Exchanges – NYSE and Amex

Дальше: NASDAQ (an Electronic Exchange)

New York Stock Exchange

Milestones. The NYSE traces its origins to a founding agreement in 1792. The NYSE registered as a national securities exchange with the SEC on October 1, 1934. The Governing Committee was the primary governing body until 1938, at which time the Exchange hired its first paid president and created a thirty-three member Board of Governors. The Board included Exchange members, non-member partners from New York and out-of-town firms, as well as public representatives.

In 1971, the Exchange was incorporated as a not-for-profit organization. In 1972, the members voted to replace the Board of Governors with a twenty-five member Board of Directors, comprised of a Chairman and CEO, twelve representatives of the public, and twelve representatives from the securities industry.

Subject to the approval of the Board, the Chairman may appoint a President, who would serve as a director. Additionally, at the Board’s discretion, they may elect an Executive Vice-Chairman, who would also serve as a director.

The Auction Market. The NYSE is an agency auction market. It means that trading at the NYSE takes place by open bids and offers by Exchange members, acting as agents for institutions or individual investors. Buy and sell orders meet directly on the trading floor, and prices are determined by the interplay of supply and demand.

At the NYSE, each listed stock is assigned to a single post where the specialist manages the auction process. NYSE members bring all orders for NYSE-listed stocks to the Exchange floor either electronically or by a floor broker. As a result, the flow of buy and sell orders for each stock is funneled to a single location.

This heavy stream of diverse orders is one of the great strengths of the Exchange since it provides liquidity. When an investor’s transaction is completed, the best price will have been exposed to a wide range of would-be buyers and sellers .

Benefits of NYSE. Listing on the NYSE affords companies great credibility because they must meet initial listing requirements and also comply annually with maintenance requirements. For example, to remain listed, NYSE companies must keep their price above $1 and their market capitalization above $50 million.

Furthermore, investors trading on the NYSE benefit from a set of minimum protections. Among several of the requirements that the NYSE has enacted, the following two are especially significant:

1. Companies must get shareholder approval for any equity incentive plan. In the past, companies were allowed to sidestep shareholder approval if an equity incentive plan met certain criteria; this, however, prevented shareholders from knowing how many stock options were available for future grant.

2. A majority of the members of the board of directors must be independent. Furthermore, the compensation committee must be entirely composed of independent directors, and the audit committee must include at least one person who possesses «accounting or financial expertise».

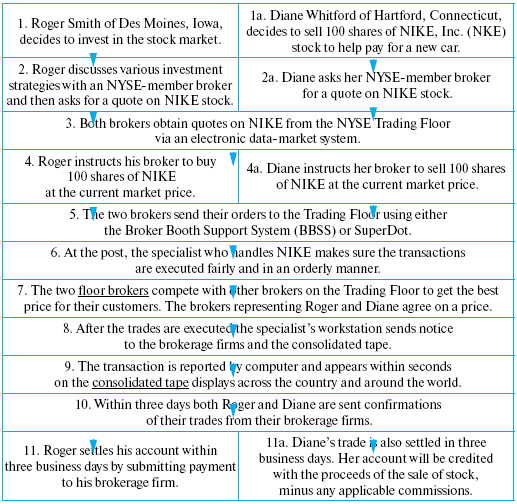

How a Stock is Bought and Sold. This chart is a detailed explanation of how a stock is traded. It illustrates how one transaction looks from three different perspectives – the buyer, seller and the stock market professionals who execute the trade.

Market Regulation. Every transaction made at the NYSE is under continuous surveillance during the trading day. The NYSE is the most active self-regulator in the securities industry. Regulations protect the integrity of the marketplace, member firms, and, most importantly, the customer.

StockWatch, a computer system that searches for unusual trading patterns, alerts NYSE regulators to possible insider trading abuses or other prohibited trading practices. NYSE’s other regulatory activities include the supervision of member firms to enforce compliance with financial and operational requirements, periodic checks on broker’s sales practices, and the continuous monitoring of specialist operations.

Назад: Auction Exchanges – NYSE and Amex

Дальше: NASDAQ (an Electronic Exchange)