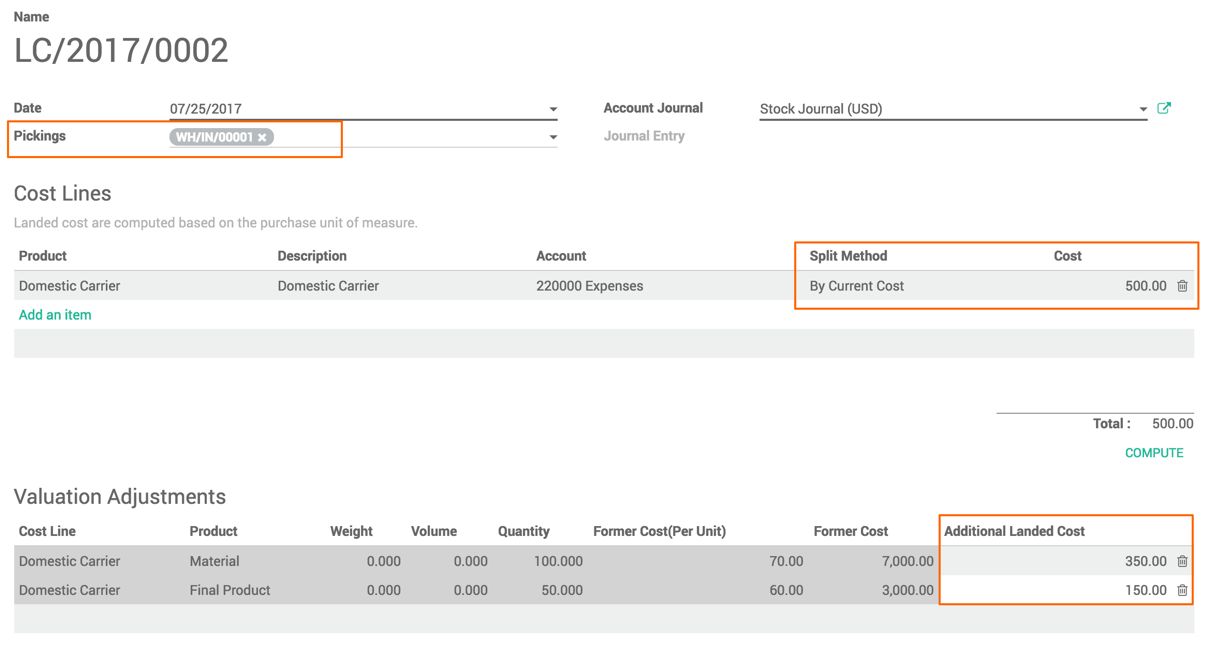

The By Current Cost method divides the total cost proportionate to the former cost of products available on the Value Adjustment lines. Look at the following screenshot to understand how it divides between the 7,000 former cost of the Material and the 300 former cost of the final products:

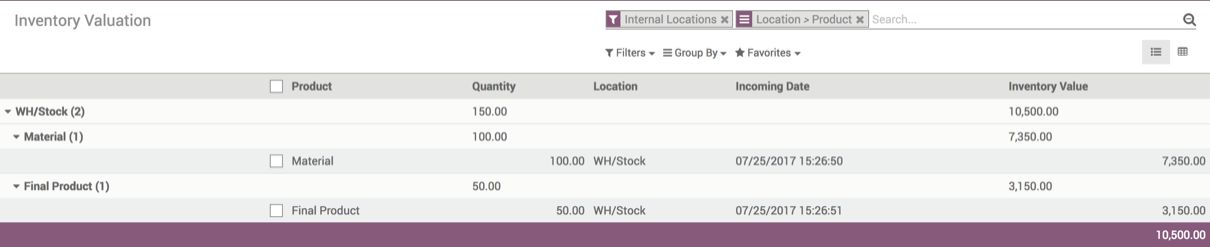

The total cost of 500 will be divided between the products equally 250 per product. Then, it will be allocated per quantity. The inventory valuation will be look like this:

The cost per one quantity will be computed in the inventory to compute the cost price. It will look like this:

| Product | Rate | Qty | By Method | Cost/Qty |

| Material | 70 | 100 | 350 | 73.50 |

| Finished Product | 50 | 50 | 150 | 63 |

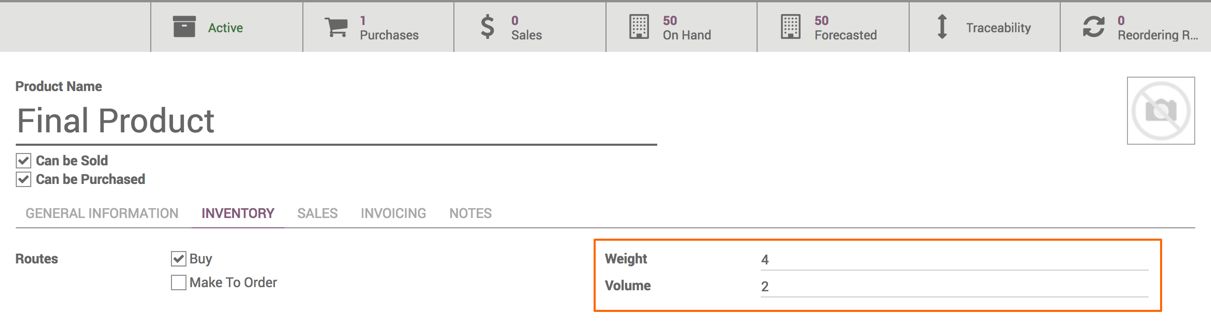

Likewise, you can check out the other two methods, By Weight and By Volume. Configure the Weight and Volume fields in the product INVENTORY tab: