- The Asset Management feature can be activated by going to Configuration | Settings in the Accounting application. Search for Asset management, select it, and click on APPLY to activate it.

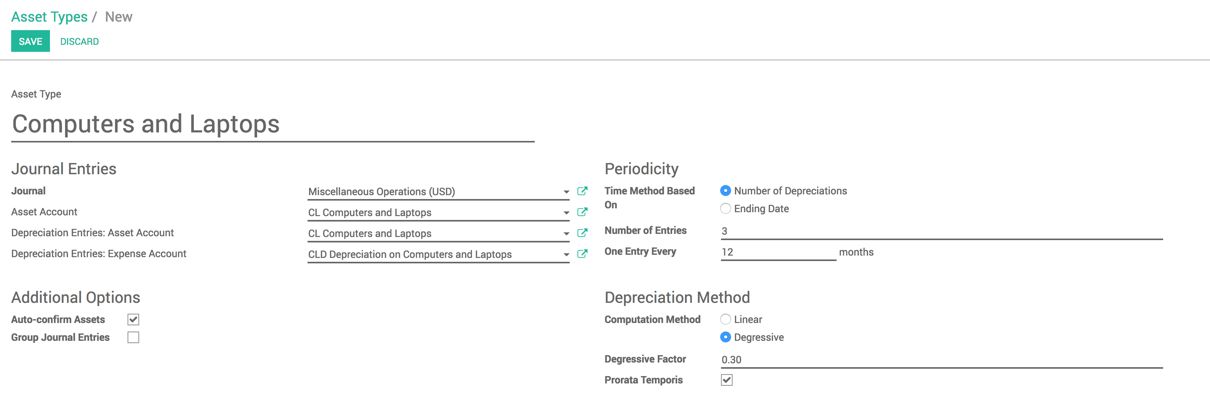

- The first thing that needs to be configured is the Asset Type on successful activation of the feature. Asset type can be a category of the asset based on how the life of an asset or the depreciation computation is defined. For example, we will create a Computers and Laptops Asset type. The life of computers and laptops will be of 3 years. The depreciation computation method will be digressive at the rate of 30 percent:

All the accounting entries will be created in the Miscellaneous Operation journal. When we buy computers and laptops, the accounting entry will be created in Computers and Laptops as a fixed asset-type account, while depreciation will be entered in the Depreciation on Computers and Laptops account.

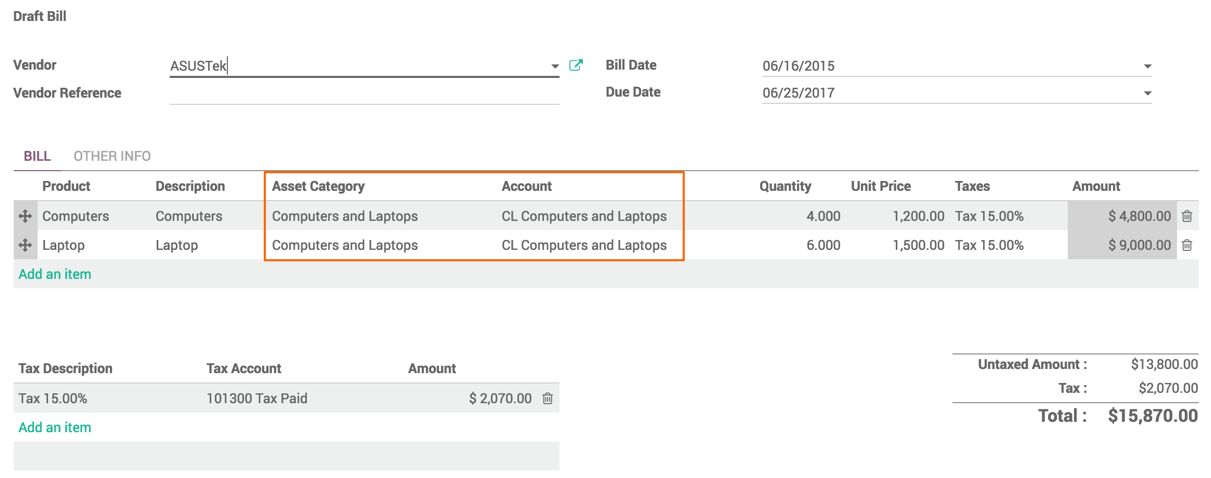

- Let's buy some computers and laptops, and link the asset category on the invoice line at the time of creating the vendor bill in Odoo:

As soon as the vendor bill is created, link the Asset Category field to the asset product. In our case, we bought computers and laptops at different prices and both linked to the same asset category group. On selection of the Asset Category field, the account on the vendor bill line will be changed automatically to the asset account.

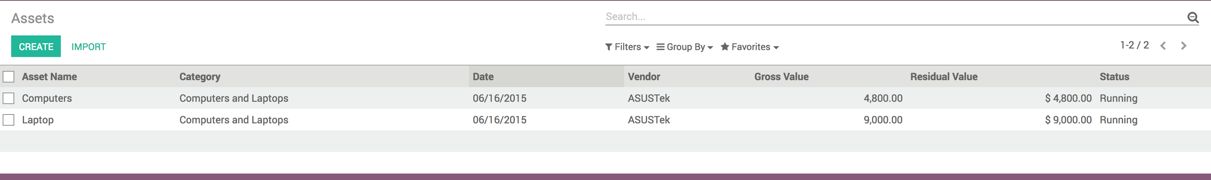

- Confirm the vendor bill. The assets will be created, and can be accessed through Advisory | Assets in the Accounting application:

We have purchased computers and laptops that have different values. Therefore, two different types of assets were created. Look at the preceding screenshot showing the list of assets created and confirmed automatically.

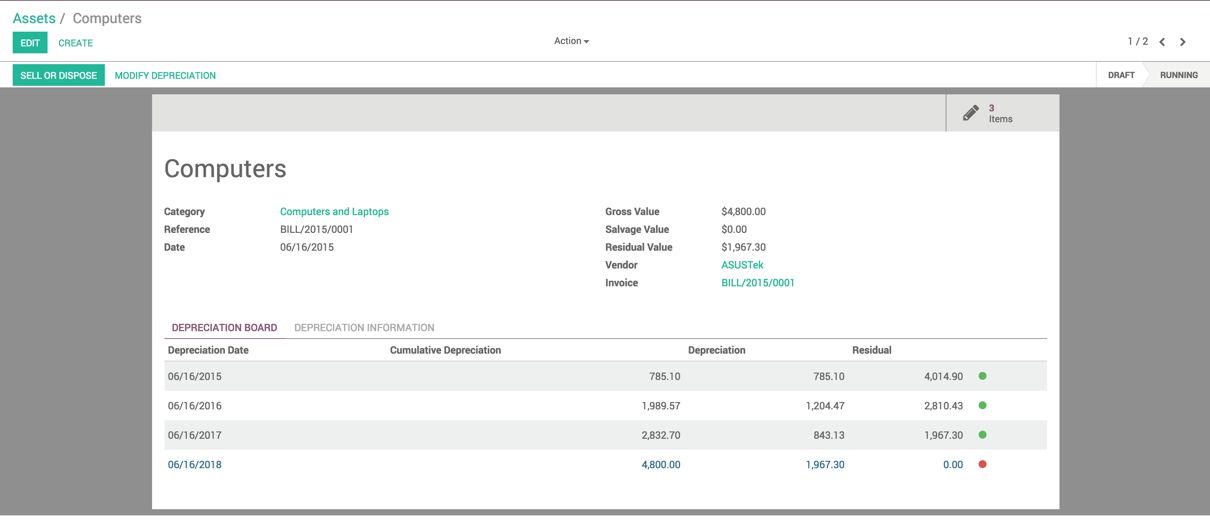

- Open an asset's form view by clicking on its record in list view. You will see the asset category, date of purchase, vendor name, and bill linked to the asset:

On the right-hand side, you can see the gross value of the asset, residual value, and salvage value. The accounting entries were created automatically by the scheduled action, but, like deferred revenue entries, the depreciation entries can be created manually using the Generate Asset Entries wizard, which can be accessed by entering the debug mode.