- To enable the Revenue Recognition feature for the accounting application, go to Configuration | Settings. Search for Revenue Recognition and select it. Then, click on APPLY to activate the feature.

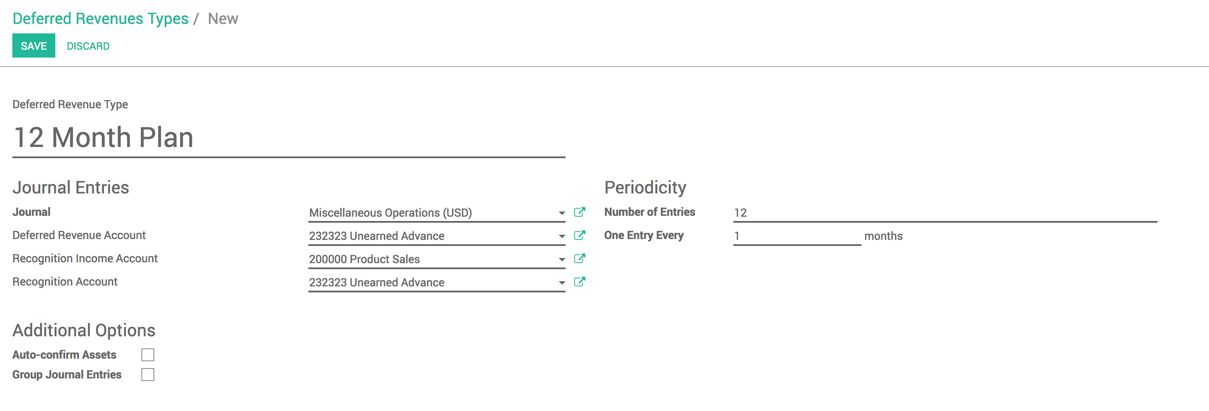

- The next step is to create a deferred revenue type by going to Configuration | Management | Deferred Revenue Type. Deferred Revenue Type has to be configured to define the accounts to be used at the time of sales, to create a liability, to identify the number of entries, and to understand when to recognize the sales, that is, every 1 month or every 2 months. Look at the following screenshot for a 12-month plan:

- The revenue recognition type has to be set on the product so that each invoice created for that product will automatically create the revenue recognition plan.

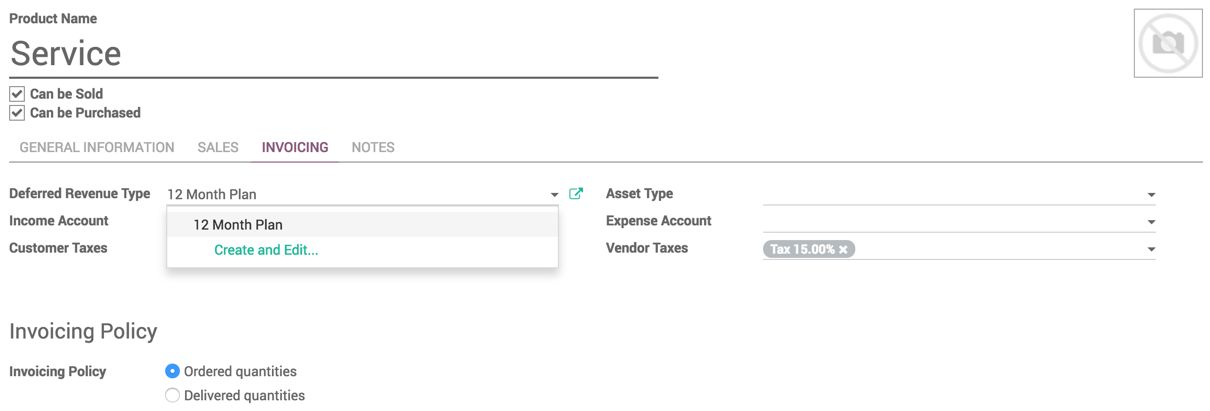

Let's set the deferred revenue type on the product. Open the service product from the Sellable products from the Sales menu. Go to the INVOICING tab and select the 12 Month Plan on the Deferred Revenue Type field:

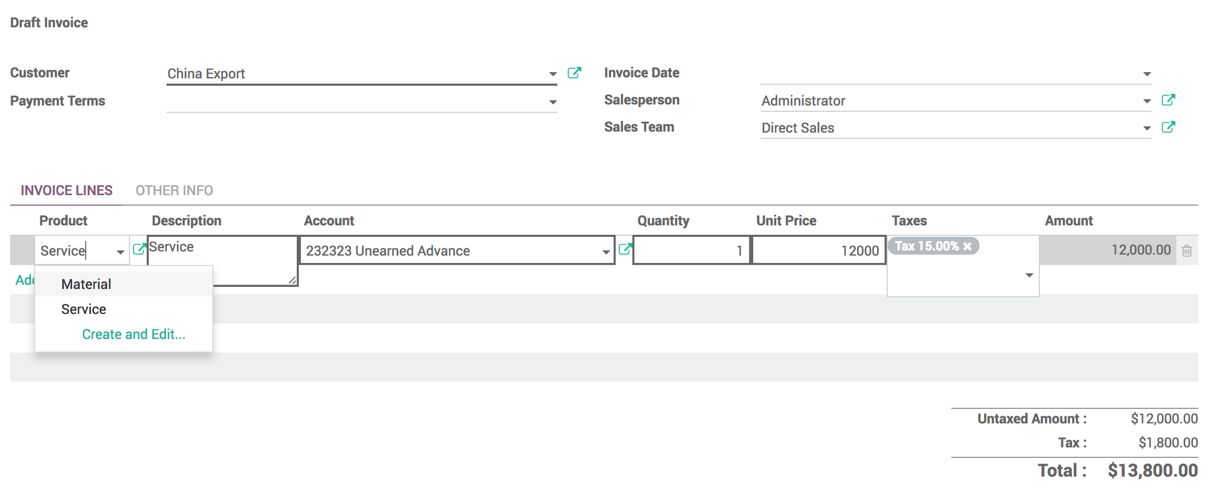

- To test the Deferred Revenue Type, let's create an invoice for the service product:

Look at the preceding screenshot. I have a sales service to China Export. As soon as the service product was selected on the invoice line, the account on the invoice line changed to Unearned Advance. Now, save and validate the invoice.

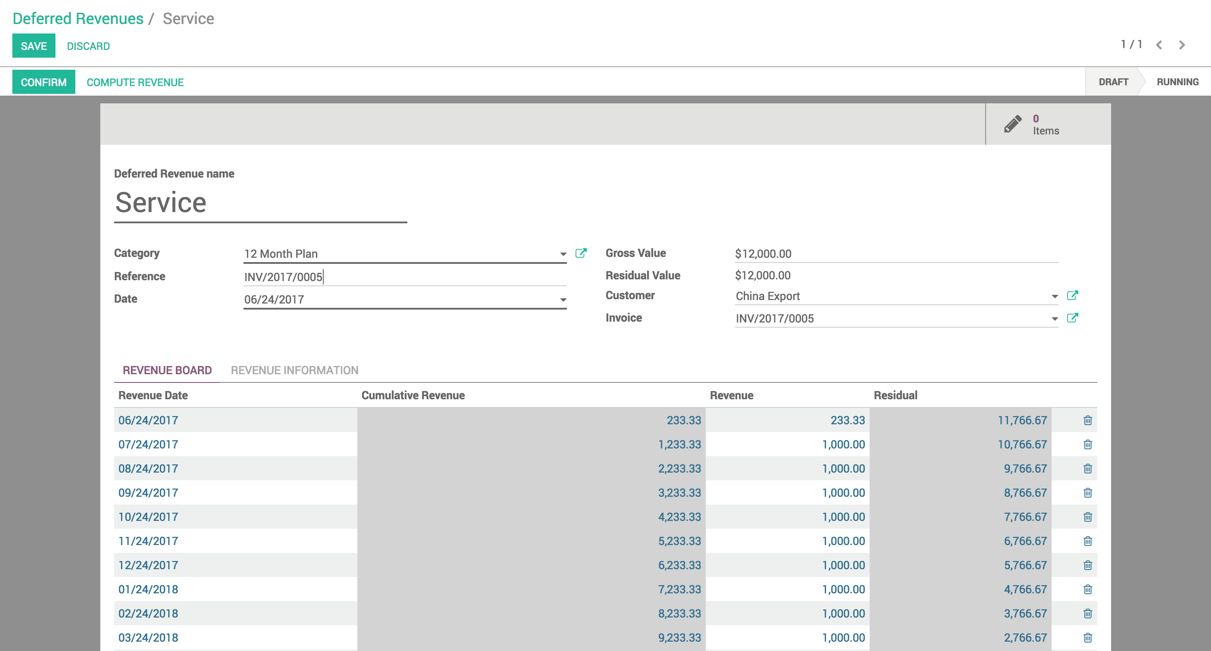

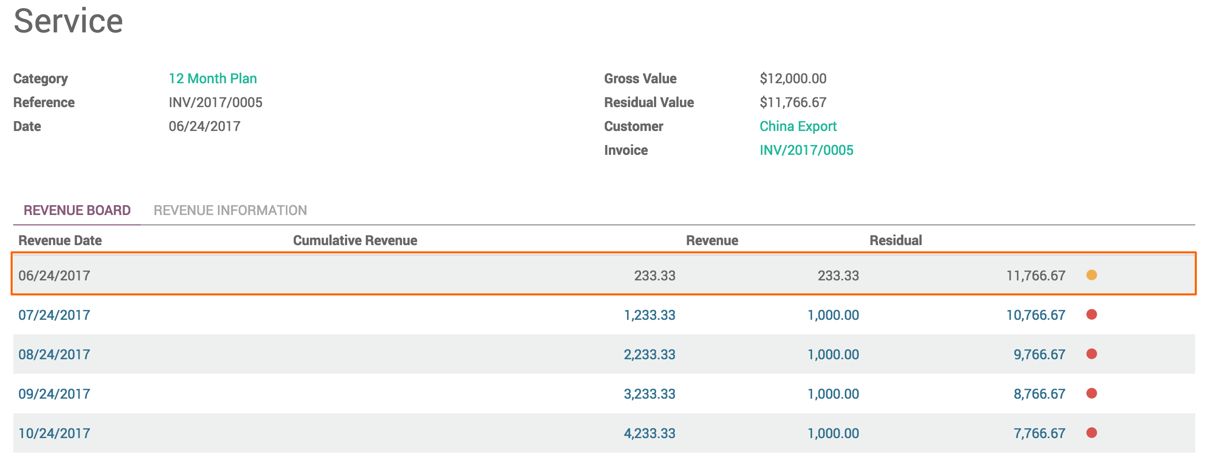

- The draft Deferred Revenues will be created by going to Advisory | Deferred Revenues. If everything goes well, Deferred Revenues is a document that contains the details of the number of installments for the revenue recognition, each with a date and amount to be recognized as an income:

You can get the link to the invoice from where it has been created. The residual value is an amount that still needs to be recognized as an income. By default, all the new Revenue Recognition is in draft mode. Click on CONFIRM to start the recognition.

- There is an automated action that takes care to post an entry for all the running Deferred Revenues.

- Each deferred revenue entry generated a color indication that represents the state of the entries itself. This indication will be based on the related accounting entry; if accounting entry was not created, the deferred revenue entry will display the RED signal. It will be in ORANGE when the related accounting entry is created but it will remain as a draft, it will become GREEN only when accounting entry confirms and posts.

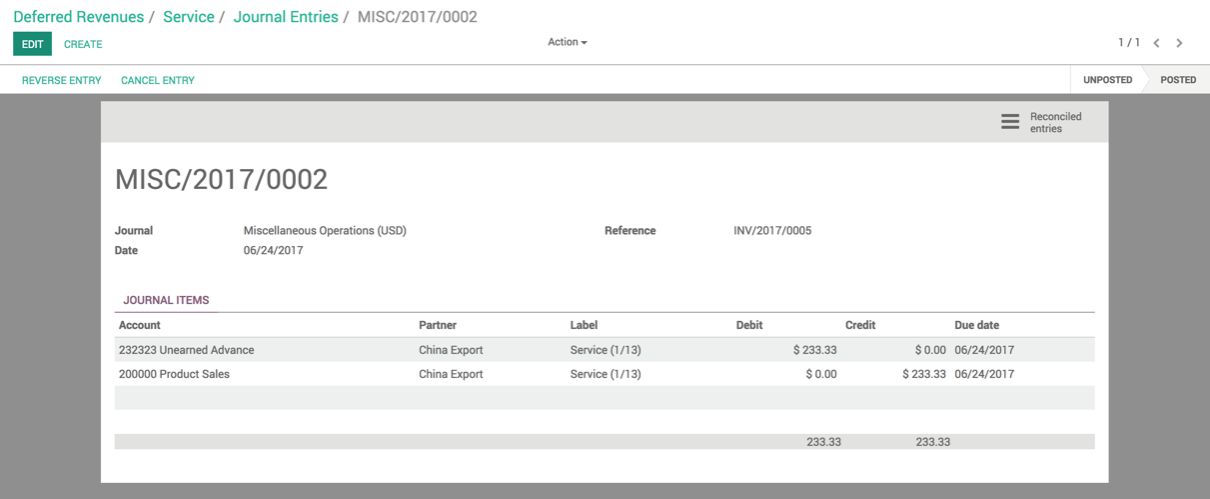

- Look at the following screen, which shows that the accounting entry was created but not posted.

- An orange signal shows that the entries have been created, but not posted yet. An accountant can review and post the entries. Click on Items. The entries created for this deferred revenue can be found here:

As soon as the entries are posted, they will become green. Look at this screenshot:

- Deferred Revenues will be closed automatically when all the entries will have the GREEN signal under the REVENUE BOARD tab.