An intercompany transaction is a primary need when you have multiple companies. Subsidiary companies are usually purchasing from the parent company and selling to the local market. There are lots of invoices or sales orders to be created for the purchases made by all the subsidiaries.

An intercompany transaction can be set up at two levels, either at Sales or Purchase application or directly at the invoicing level.

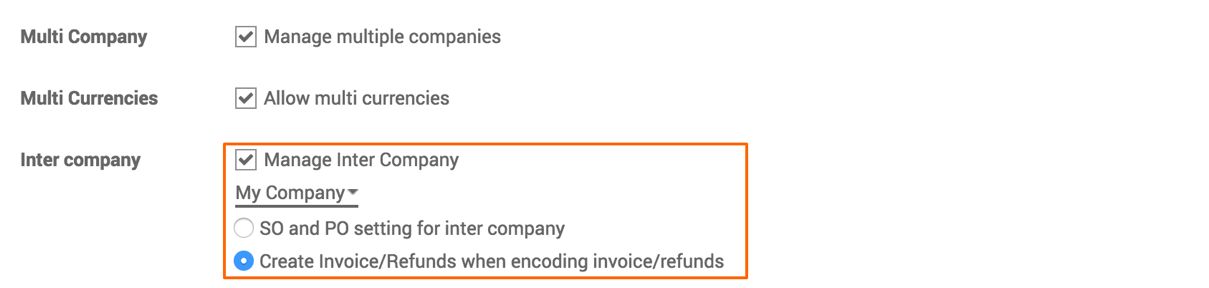

The intercompany transaction rules can be activated by going to Settings | General Settings. Look at the following screenshot. Select the Create Invoice/Refunds when encoding invoice/refunds option to set up intercompany transactions at the invoice level:

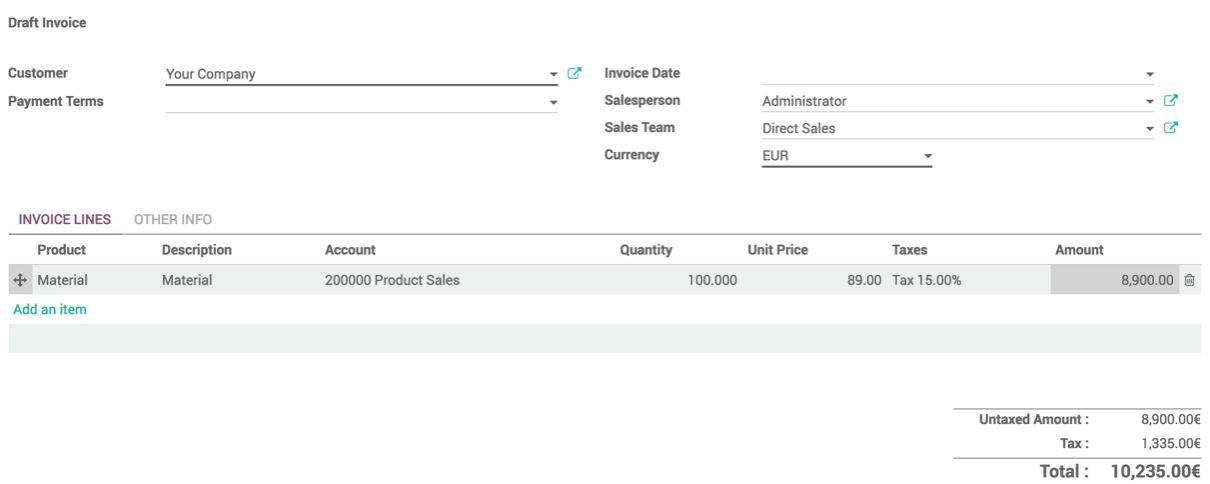

When the parent company (My Company) creates customer invoices, the vendor bill will be created automatically for the child company (Your Company). Look at the following screenshot. It shows an invoice created for Your Company:

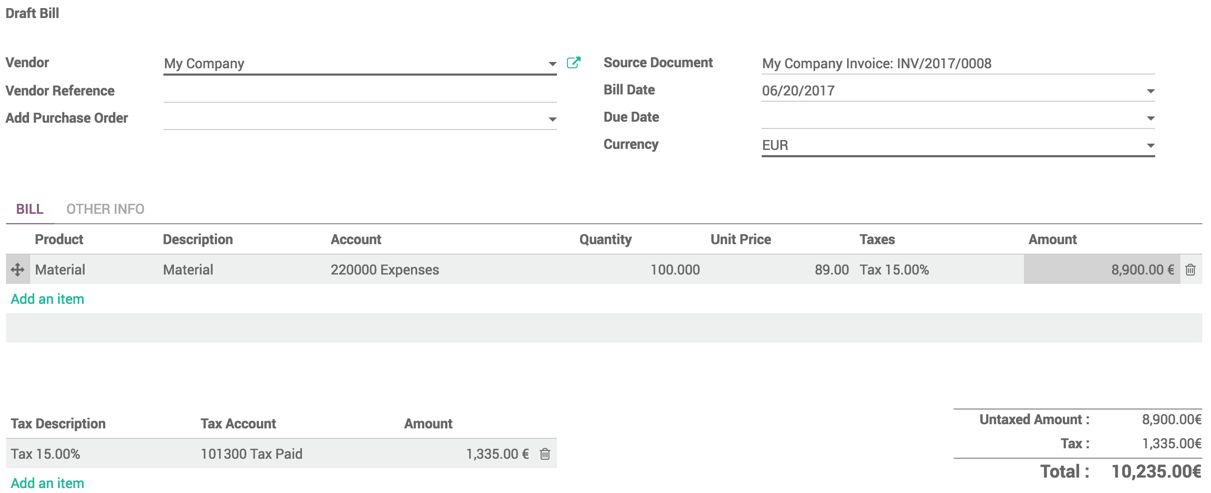

The vendor bill will be created in Your Company automatically when the customer invoice is confirmed in My Company. Look at the screenshot here:

The taxes have to be verified and applied manually based on the customer invoice; they will not be applied by default. You can choose to integrate at the Sales or Purchase level if you need advanced rules for the intercompany transaction.