- Odoo reports are generated in real time and do not require a special treatment or condition to generate any of the financial reports.

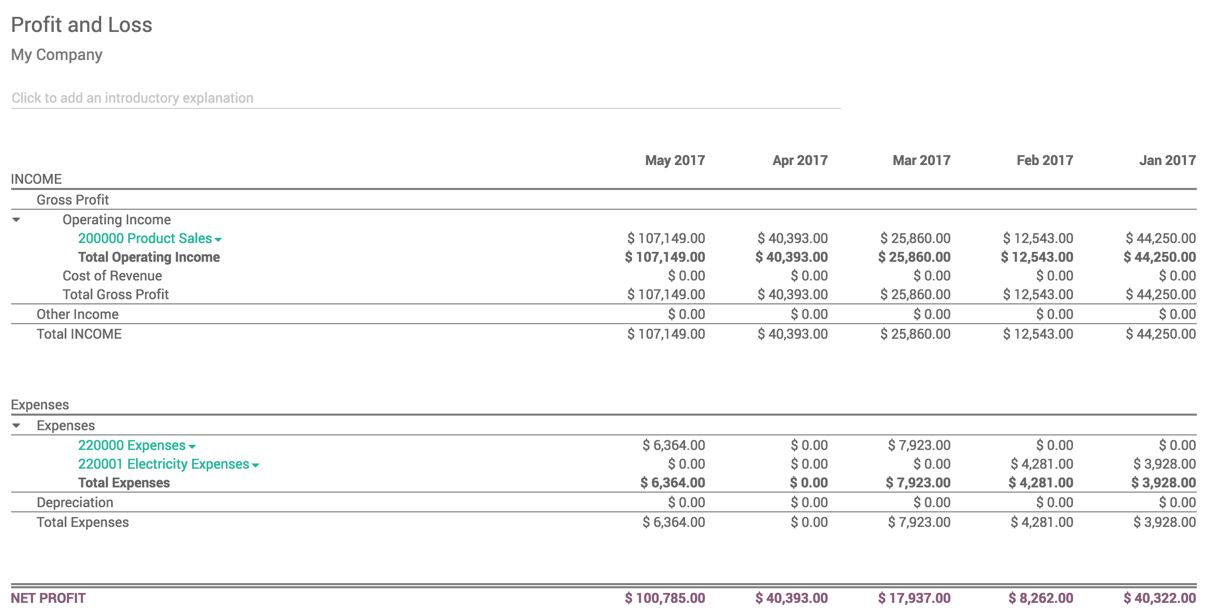

Before closing the financial year, let's check the current year's earning or loss after the audit process completed. The report is available at Accounting | Reporting | Profit and Loss. Look at the following screen of an audited profit and loss account:

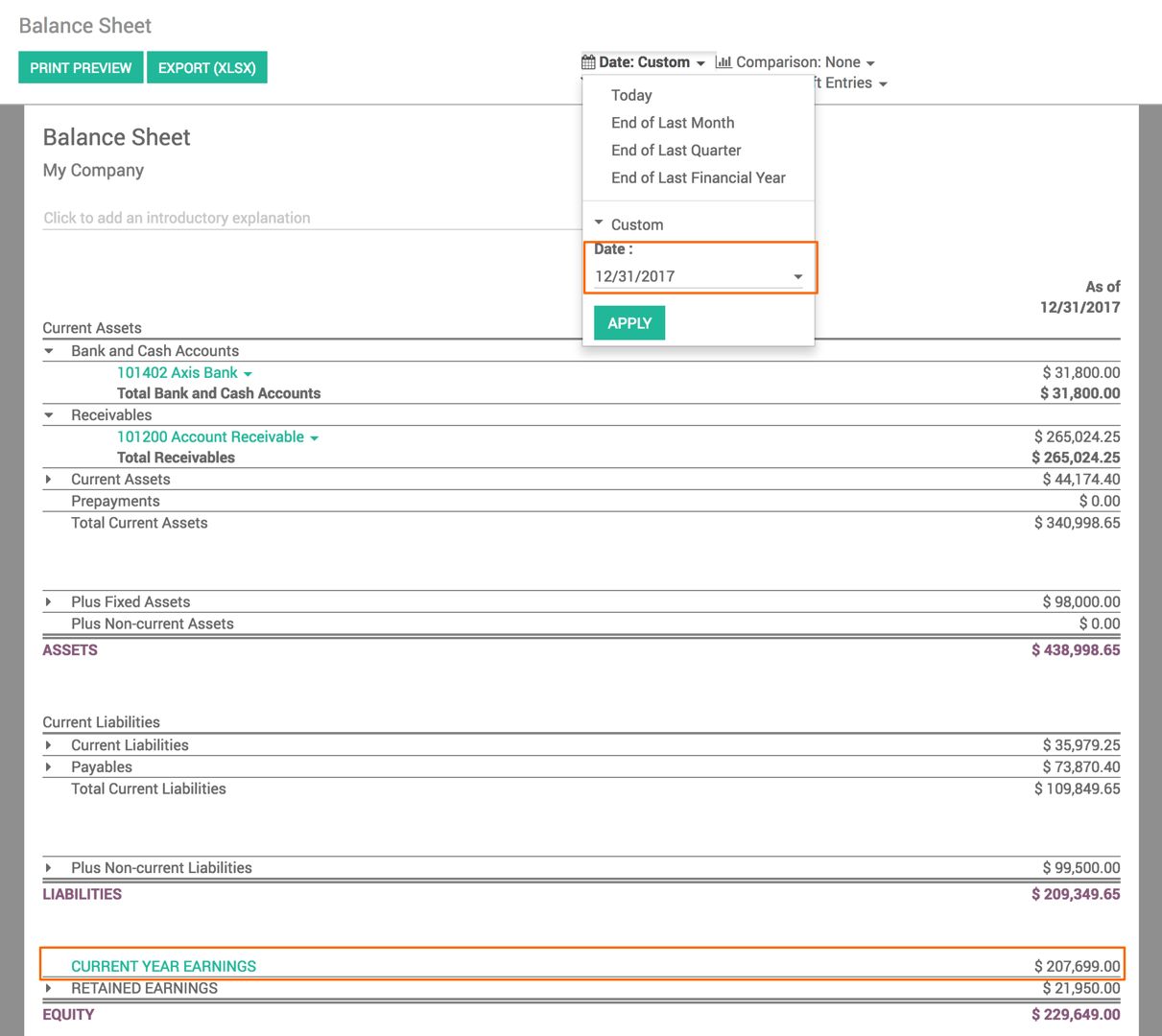

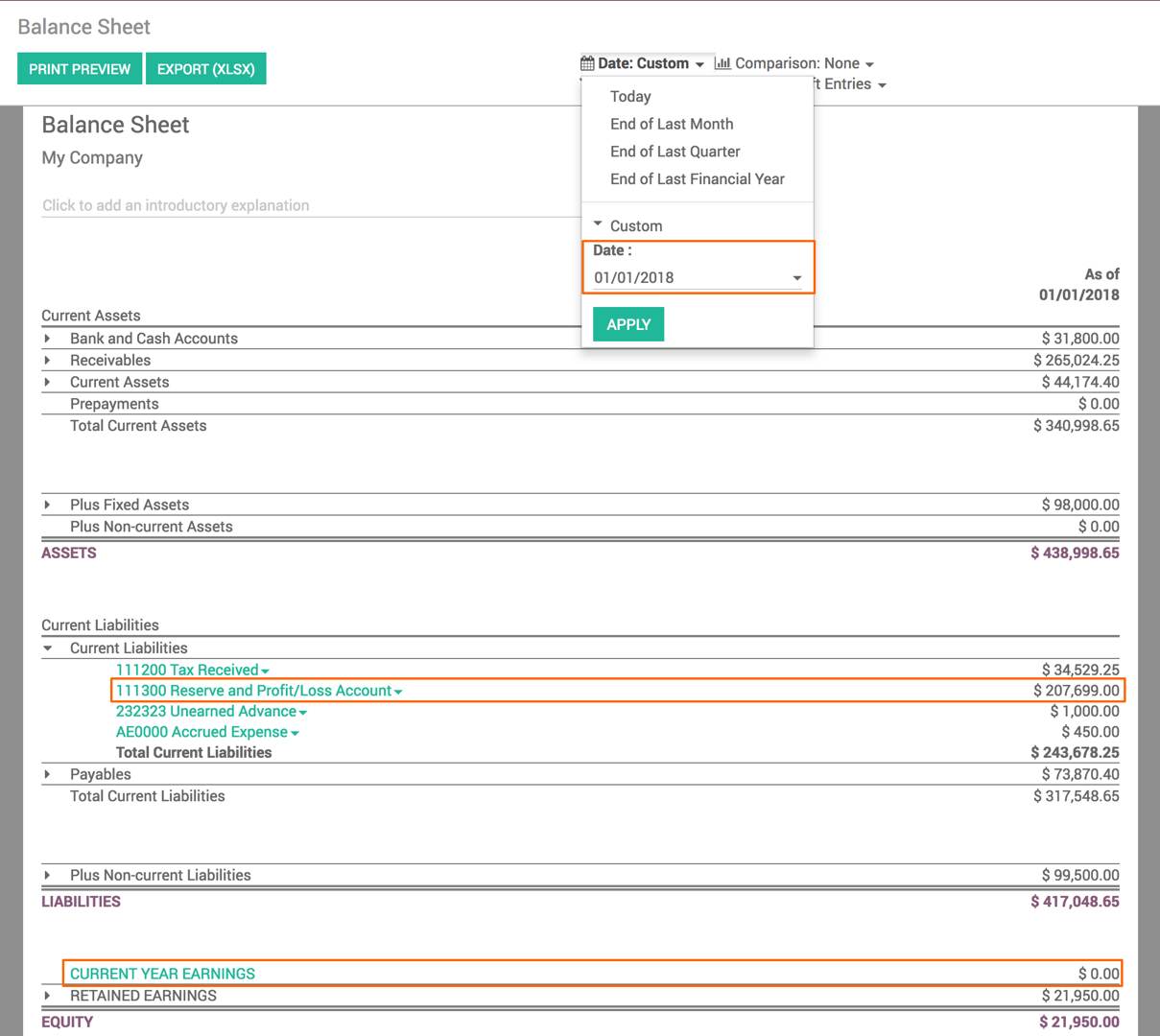

- As soon as the statement finalizes after the auditing, the second step is to transfer the NET PROFIT or NET LOSS from the Profit and Loss account to the Balance sheet, in most of the companies it's a Reserve and Surplus account. The actual profit will be distributed later among the stack holders. Let's check the balance sheet. It shows the profit under the CURRENT YEAR EARNINGS section, as the following screen:

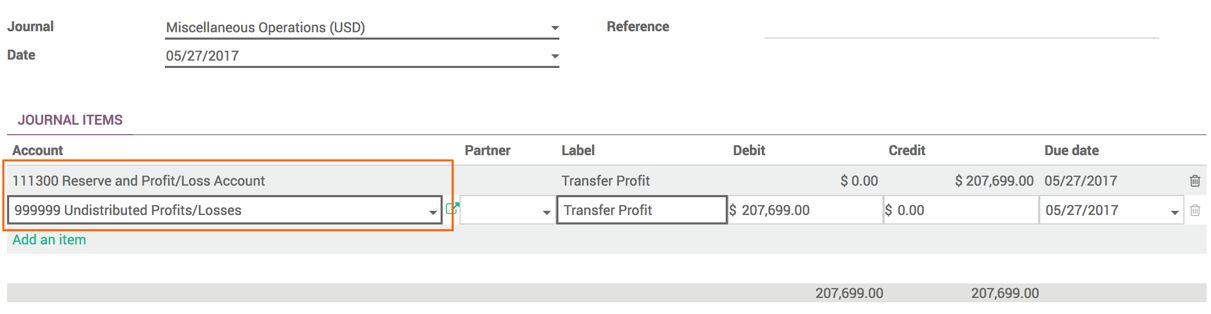

Create a journal entry, as shown in the next screenshot, to transfer the profit or loss to the reserve and surplus account. Every chart of account has a special account called Undistributed Profits/Losses with the account code 999999, which holds the current year's profit or loss:

Post the journal entry to confirm the transfer of profit or loss to the reserve and surplus account.

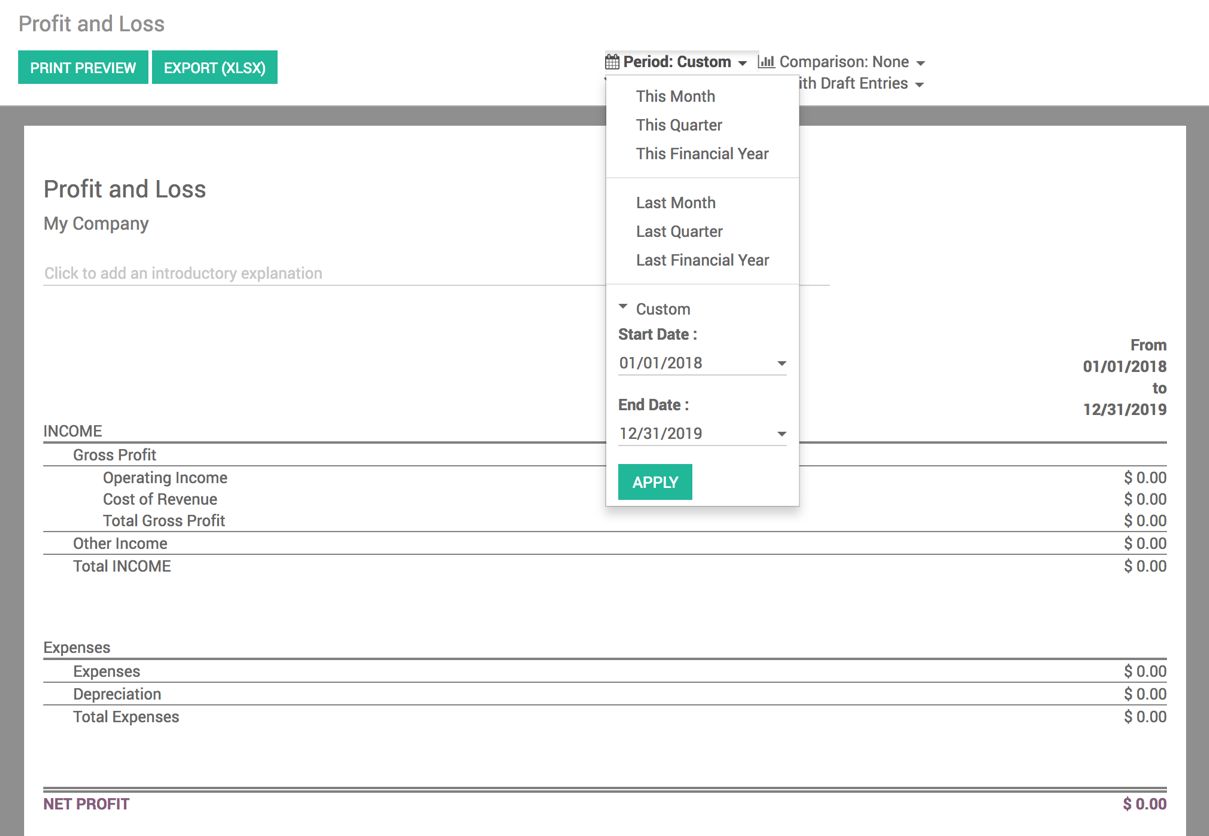

- Check the Profit and Loss account and balance sheet reports after posting the journal entry. You should see the Profit and Loss account initialized for a new financial year as follows:

- The CURRENT YEAR EARNINGS in the balance sheet is set to 0 as the profit is transferred to the Reserve and Profit/Loss account. Look at the balance sheet report after the entry:

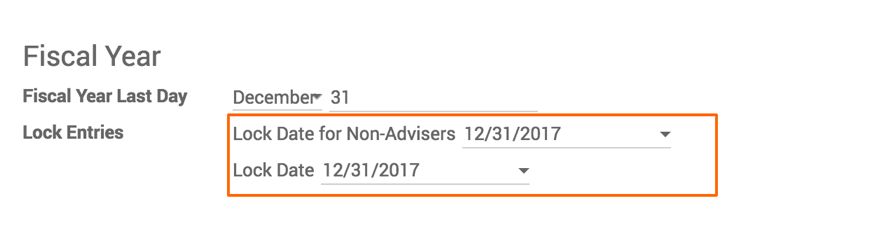

- Once the profit or loss has transferred correctly, we are ready to close the financial year by setting the dates under the Lock Entries section available in the Accounting | Configuration | Settings page. Look at the following screen:

Setting Lock Date for Non-Advisers has to be set before the audit or year-end closing process starts as once the date is passed the accountant should not change the past year entries.

The Lock Date is important as once this date is set no one, including an advisor, can make changes or creating a new entry before Lock Date, in our case either accountant or adviser cannot change or create a new entry before the date 31/12/2017.