- The taxes applied in your country are installed automatically for most localizations. The default taxes will be appearing on sales orders and invoices coming from each product's Invoicing tab.

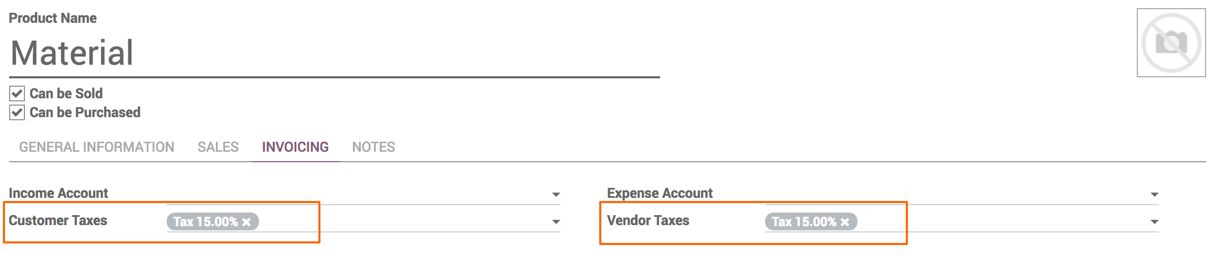

The taxes selected on the product form are the default taxes applied for sales and purchase of that product:

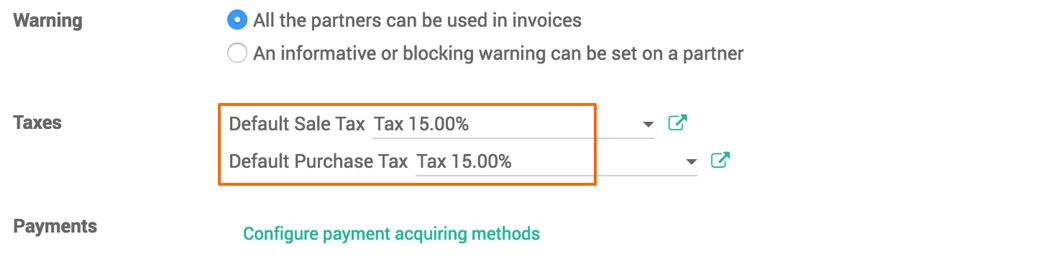

- The default taxes set on the product at the time of creating a new product are coming from the account default configuration. To change the default taxes set for any new product created, go to Accounting | Configuration | Settings:

Change the tax configuration for two fields Default Sales Tax and Default Purchase Tax. Normally Default Sales and Purchase Tax is same. Look at the following screen of the default tax configuration:

Change the Tax and click on APPLY button to save the tax. The new tax will be applied on the product created after setting the default taxes.

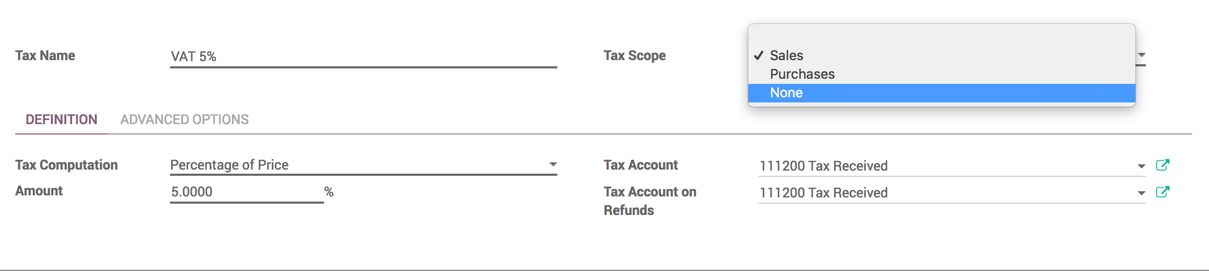

- When the tax is not available as part of the standard Chart of Tax, you can create a new one from Configuration | Taxes under the Accounting application. You can create a tax that can be a sales tax or purchase tax. Let's create a new tax, VAT 5%, which will be applicable by default on all the products instead of Tax 15%:

- Enter VAT 5.0% in Tax Name. Tax Scope will be Sales. Select Tax Scope as Purchase if you want to create the purchase tax, or set None when you create a tax as a part of some other tax. Tax created with Tax Scope as None, cannot be applied either on Sale or Purchase order.

Select Percentage of Price in Tax Computation. Enter 5.0000% in Amount. Link tax with the account so the ledger will be generated based on the tax transactions. You can select this new tax, VAT 5 percent, as the default tax under the Configuration | Settings of Accounting application.

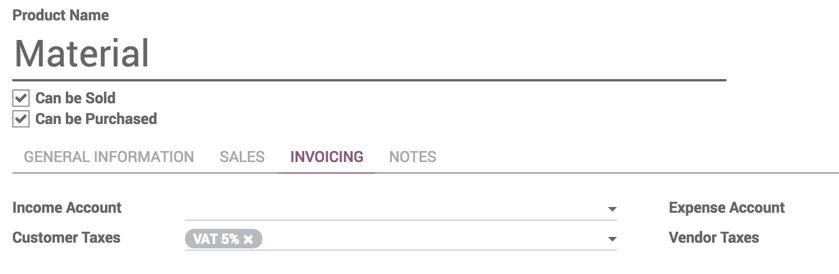

- The new tax created and set as default will be applied to all the new products created. Look at the following screenshot, 5% VAT is applied when creating a new product called Material:

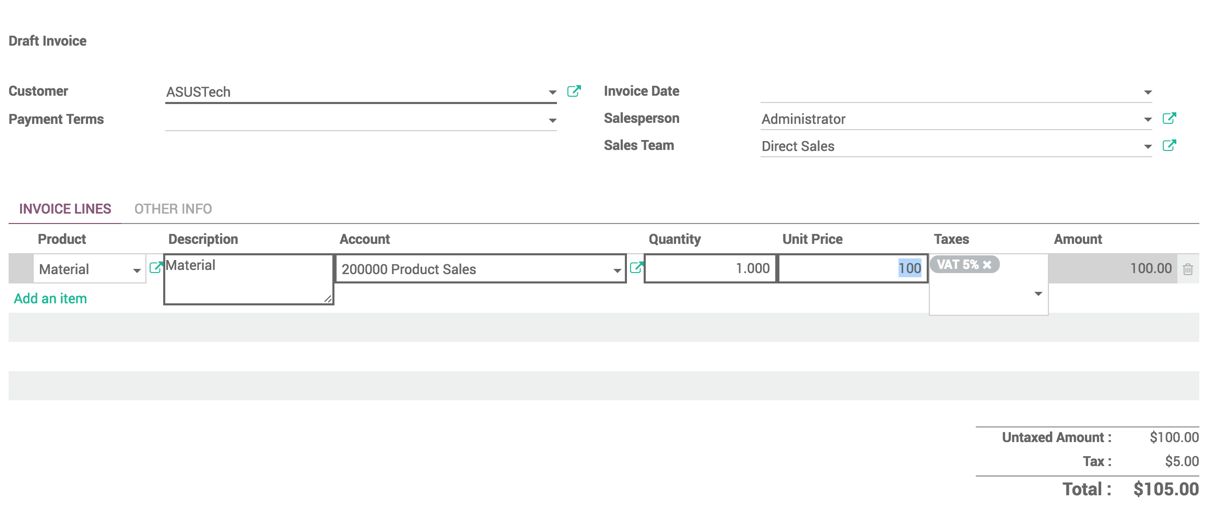

- Let's create an invoice and select the Material product; the default tax applied to the material is VAT 5%:

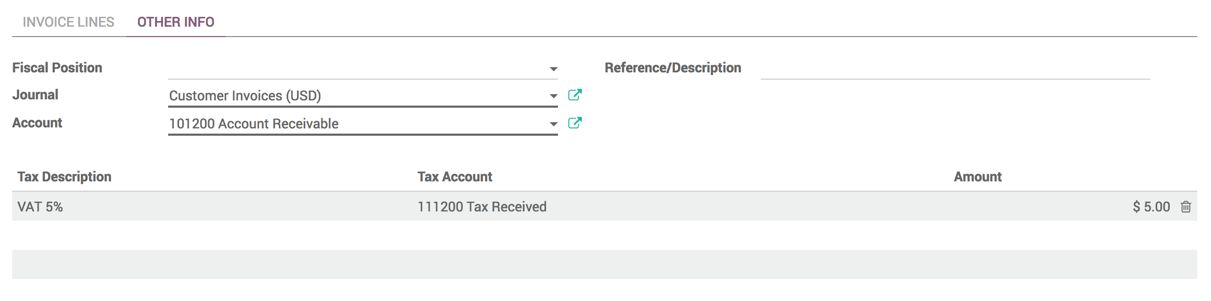

- The taxes are computed correctly on the invoice, the detailed computation of the tax can be found under the OTHER INFO tab on the invoice. Look at following screen to see the tax computation:

We can see only one line which computes the VAT 5 percent. You will be finding multiple tax liens if you have multiple taxes applied on different products.

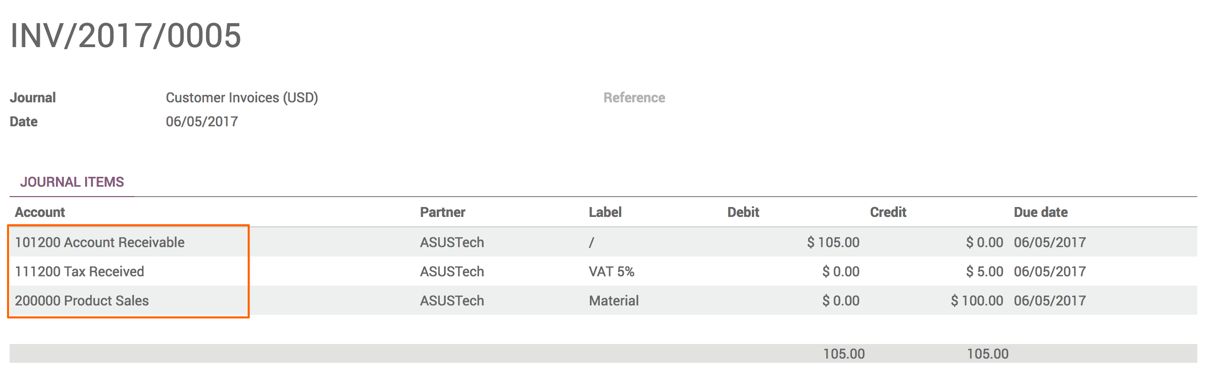

- As soon as the invoice is confirmed, the accounting entries will be created, which generates the general ledger entries for the Sales, Accounting Receivable, and Tax Received account. Look at the following screenshot that shows the accounting entries created when an invoice gets confirmed: