Mark as Deprecated if any account is not useful; click on the form view to deprecate the account.

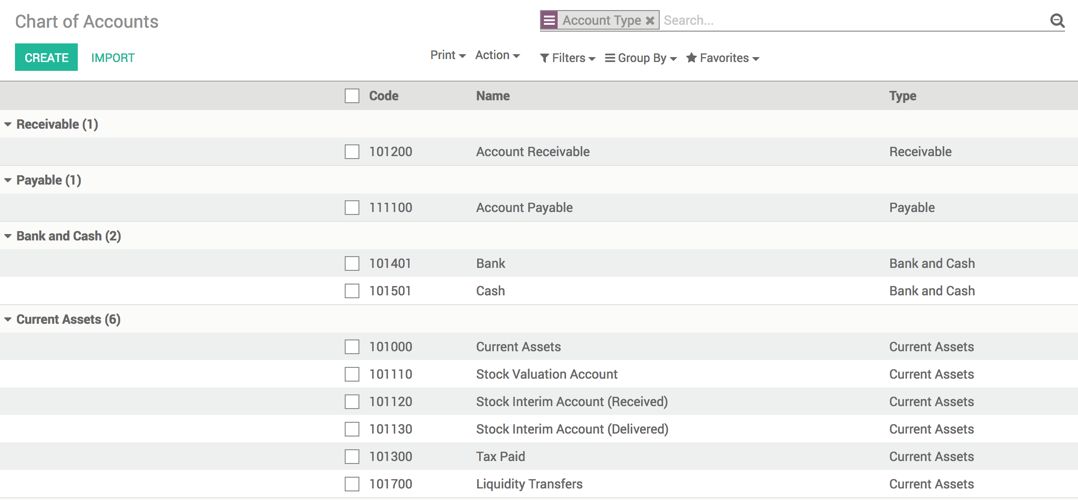

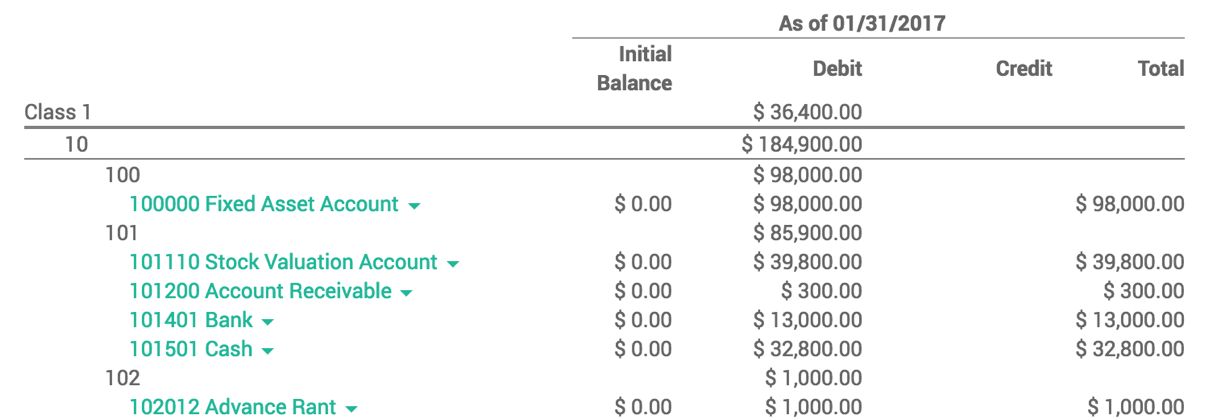

Code is an important field; the hierarchy in a chart of account can be created with the code. The following screen represents the Current Assets hierarchy:

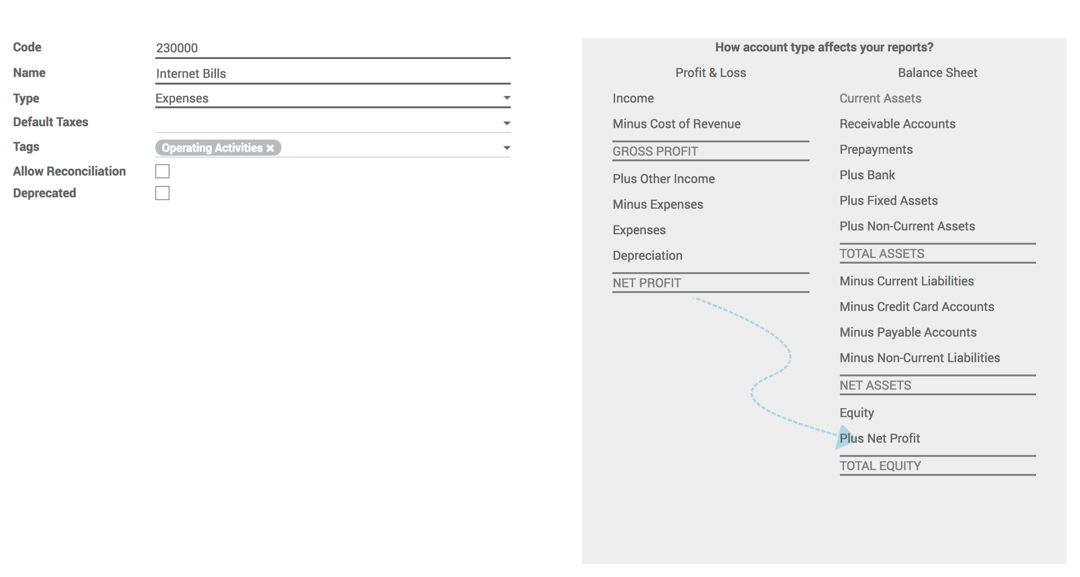

Enter the name of the account; the same name will be printed on the report and depending on the type, the account will be linked to the respective heads--either to Expense or Income under the Profit and Loss account or to Assets or Liability under the balance sheet.

Accounts Receivables and Accounts Payables need a ledger to identify with which customer or supplier you have outstanding receivables and payables and what will be the due date.

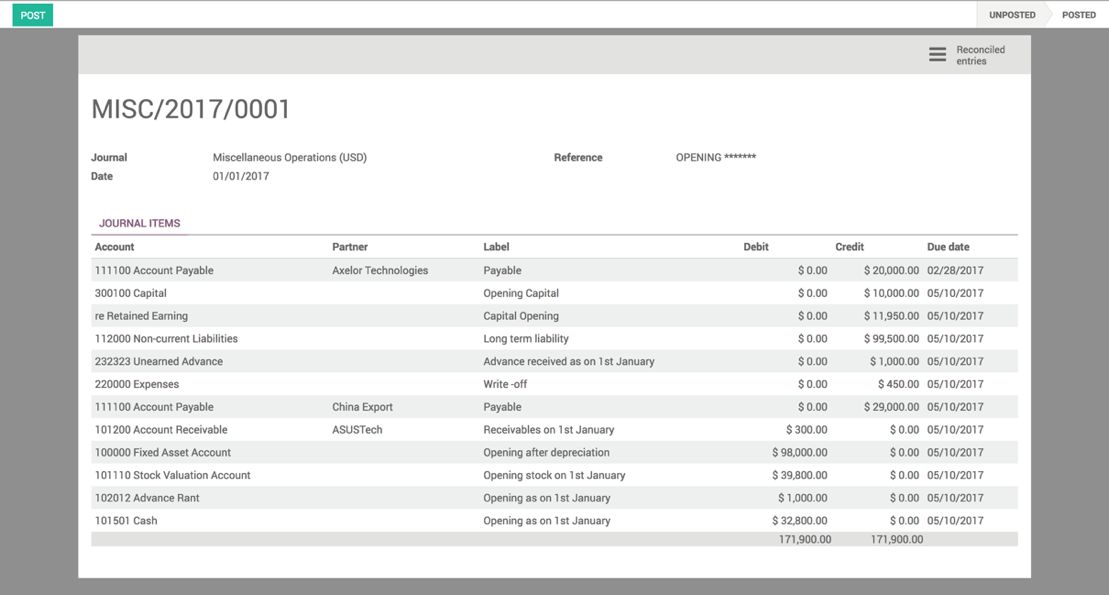

To create a journal item, click on the Add an item link on the JOURNAL ITEMS field. Select the account, the partner should be selected if the account is payable or receivable, enter the label, and enter the debit or credit balance.

The due date has to be set on all the journal items. Journal items which belong to accounts payable or receivable have an actual due date while other lines have the due date as the first day of the new financial year has to be set:

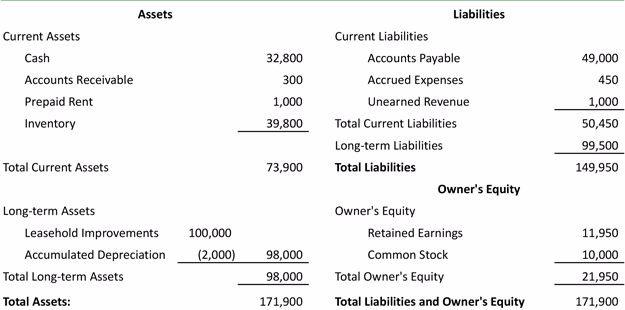

The debit total should be equal to the assets, and the credit total should be equal to the liability. Both the debit total and credit total entries should match to save the entries in Odoo. Before you post the entries, verify Due date for all the entries. The Partner Aged balance report will be computed depending on Due date. Click on POST to post the entries.

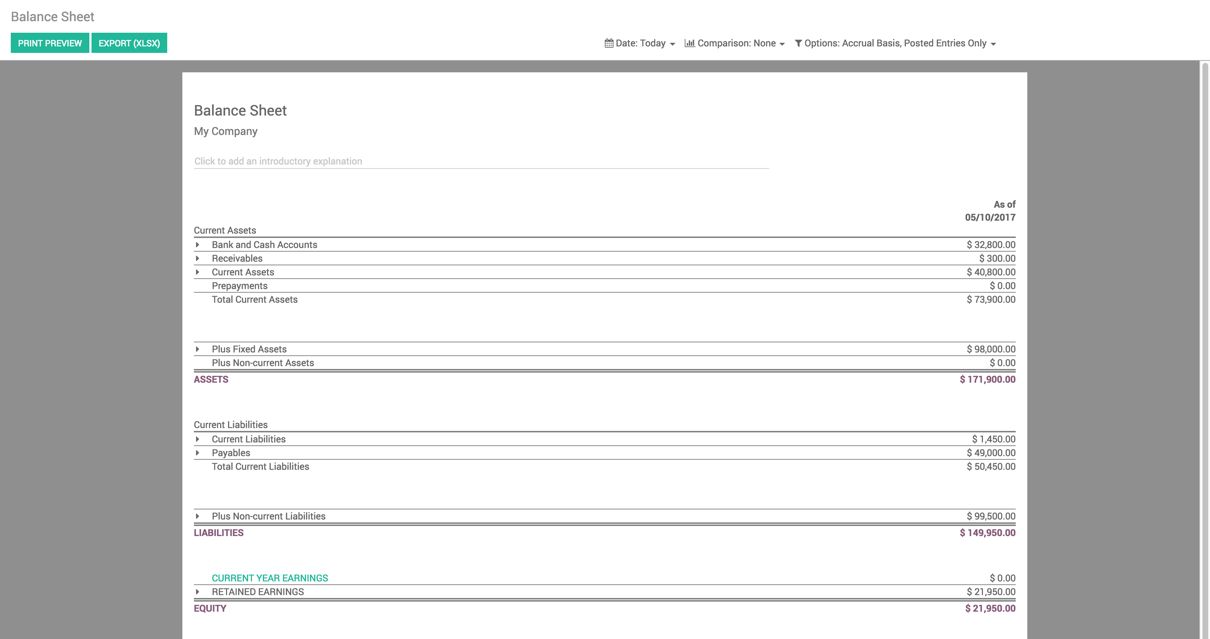

If the balance sheet printed from Odoo does not match with your balance sheet, make sure that you selected the correct account during the opening entry, and set the correct type on the account you created.

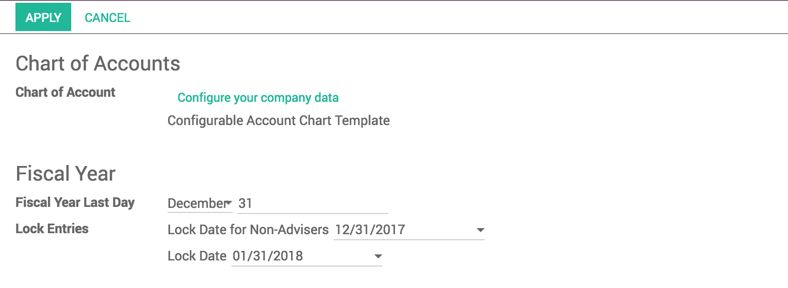

At the end of every financial year, the old accounting entries can be locked through Configuration | Settings. There are two different levels of locking: one for an accountant and one for an adviser. To lock an entry for the accountant, enter the date in the Lock Date for Non-Advisers field. The auditor can still make the modifications, and once the audit process completes you can enter Lock Date, which locks modification of entries before the entered dates.